Finance

Gold and silver prices up by 2% amid positive global cues

Gold gains from 1-week low as dollar declines amid peak wedding season demand

Silver trades flat, 8% off peak level

How to use a housing loan EMI calculator to plan your loan repayment

MedPlus Health's shares fall over 3 pc after drug license suspension of subsidiary stores

High-Return Investment Options with Tax Benefits

From sugar to IT exports, GST rejig to boost Maharashtra's economy

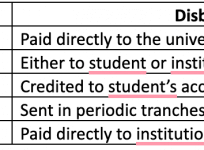

How Education Loan Disbursement Works for Students

GST 2.0: Empowering livelihoods and growth in Uttar Pradesh

SBI sees inflation below RBI projections, calls it a regulatory policy too

Gold price stays elevated buoyed by US shutdown risks, rate-cut bets

UPI transactions see 31 pc growth at 19.63 billion in September: NPCI data

RBI Monetary Policy Committee unlikely to cut rates in October: Report

Indian banks performing exceptionally well: FM Sitharaman

Advertisement

Advertisement