Receiving an admission offer from your chosen university is a major milestone for every aspiring student. However, arranging timely funding is equally important to move forward. Education loans play a vital role in transforming academic aspirations into reality by covering tuition, living expenses and other study-related costs. The education loan disbursement stage follows loan approval and marks the moment when sanctioned funds are released to the institution or, in certain cases, to the student. Understanding this stage helps students plan fee payments, meet university deadlines and avoid last-minute financial disruptions. Here's a look at what you need to know about your abroad education loan disbursal process.

What Does Education Loan Disbursement Mean?

Here's the simple answer: education loan disbursal refers to the stage after your loan is approved when the sanctioned amount is released, either in parts or as a lump sum. The money usually goes straight to the university or college, but certain expenses like travel or living costs may be credited to your account. Think of it as the bridge between "loan approved" and "fees paid." Without this bridge, students might risk missing critical payment deadlines that could impact their enrolment.

The Student Loan Disbursement Process

The loan disbursement process for education loans is fairly straightforward. However, some details may vary depending on your country of study or the university's specific requirements. Here's a general flow to guide you:

Loan Approval and Sanction Letter

Once your application is reviewed, you receive a sanction letter that states the loan amount, repayment terms, and education loan interest rates. This document is crucial. It outlines the financial support you're eligible for.

Document Submission for Disbursement

To initiate disbursement, you'll need to provide your admission letter, fee schedule, and visa details if you're studying abroad. Missing or incomplete paperwork often causes delays.

Disbursement Request

A formal request is made by you or your co-applicant before the due date of each instalment. This ensures funds are aligned with university deadlines.

Verification of Fee Schedule

Your loan provider cross-checks the university's fee demand letter to confirm accuracy. This step ensures that payments are made on time and for the correct amount.

Release of Funds

Funds are then transferred, typically semester-wise or annually. For international students, payments are often made in foreign currency and transferred directly to the university's account.

The Avanse Education Loan Disbursement Process

When it comes to the Avanse loan disbursement process, the focus is on student convenience and institutional timelines. The process is designed to be efficient and transparent:

Step 1: After receiving your sanction, submit the required documents, such as admission proof and fee schedules.

Step 2: Avanse verifies the information and prepares the necessary disbursement letters.

Step 3: Depending on the type of expense, funds are released directly to the institution or to your account.

Thanks to its tech-enabled systems, the Avanse disbursal process is known for quick turnaround times. Many students consider it among the fastest student loan disbursement options available.

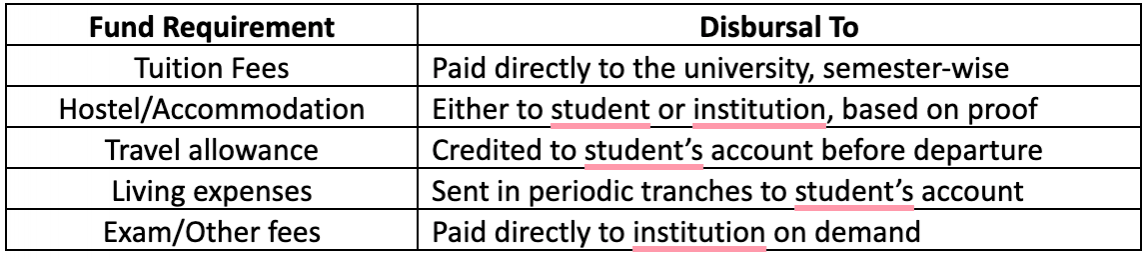

Avanse Loan Disbursement Pattern

Want to better understand how the funds get disbursed and who they go to? Here's a quick glance.

This structure ensures that funds are allocated exactly where they are needed, preventing misuse while giving students access to essential allowances.

Factors That Influence Your Loan Disbursement

Several factors can affect how quickly your loan is disbursed. Knowing these in advance helps you avoid surprises:

Paperwork Issues

Missing documents or mismatched details are the most common reasons for delays.

Admission Confirmation

Disbursement only begins once your admission is officially verified by the institution.

University Deadlines

Since each university follows its own payment schedule, instalment dates are tied to those deadlines.

Regulatory Checks

International transfers often require additional compliance verification, which may extend timelines.

Tips for Smooth Disbursement

If you'd like to ensure a seamless process, here are some useful practices:

- Start your disbursement request at least a few weeks before the deadline.

- Double-check all supporting documents, especially fee letters and visa details.

- Maintain regular communication with your loan provider for status updates.

- Keep copies of all disbursement letters for your records.

Why Understanding Disbursement Matters

The disbursement stage is more than a financial transaction. It's the key to ensuring your academic journey continues without disruption. By understanding how the process works, especially with education-focused lenders like Avanse, you can stay ahead of deadlines, manage costs better, and focus on what really matters: making the most of your education. Timely access to funds means you can:

- Pay tuition fees without stress

- Secure accommodation before deadlines

- Manage living expenses abroad smoothly

- Stay focused on studies rather than worrying about money

Studying abroad is a dream for many, and an education loan often makes that dream possible. But securing the loan is just one part of the process. Knowing how and when the funds will be released is equally vital. The disbursement process ensures that your tuition, accommodation, and other costs are covered on time so your academic aspirations don't hit a financial roadblock. With a clear understanding of the process and by planning, you can make your transition to university life smooth and worry-free. After all, the journey of learning should be about knowledge and growth, not about waiting anxiously for payments to clear.