Getting the EMI right isn't guesswork anymore, as you can take into account existing policies and maths. Since October 2019, most new floating rate home loans have been tied to an external benchmark, typically the RBI's repo rate, and reset at defined intervals. This means your EMI now reacts faster and more transparently to policy moves than under the old MCLR regime.

With the current repo rate unchanged at 5.50% (as of early October 2025), your planning should start with the right tools. You can use an EMI calculator to anticipate monthly outgo, a home loan eligibility calculator to keep total EMIs within the usual 50–55% of income comfort band, and then stress-test rate changes before you avail of a home loan.

Using a housing loan EMI calculator to plan your repayments

Start by calculating a safe loan amount

Open a home loan eligibility calculator first. Enter your age, income, fixed expenses, and any existing EMIs. The tool estimates a safe loan amount and a ballpark tenure. This protects you from over-borrowing and helps you shortlist properties that match your cash flow.

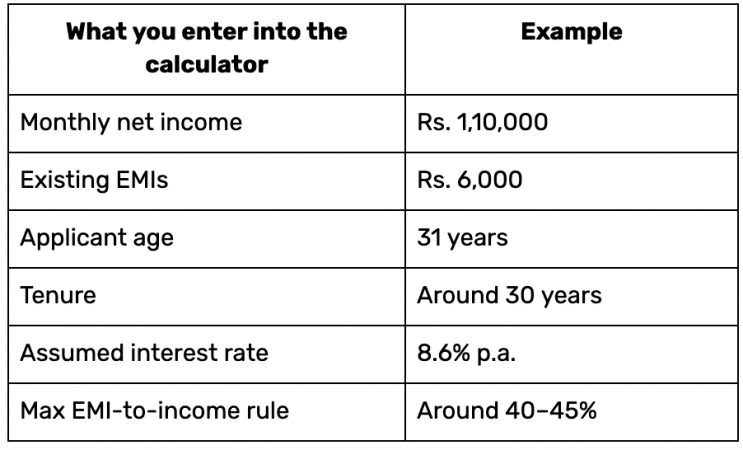

Let us look at an example:

Once you enter these values in the calculator, you will see that you are eligible for a loan amount of approximately Rs. 50–55 lakh (subject to lender policy and documentation).

Finalise your EMIs

You can now enter the chosen loan amount into an EMI calculator with the current rate and tenure.

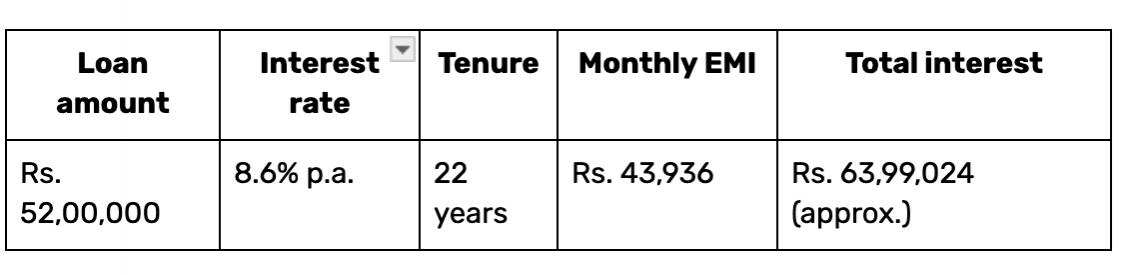

For example:

If the EMI feels high, consider lowering the loan amount (by making a higher down payment) or extending the tenure slightly. Re-check the revised amount with the home loan eligibility calculator to stay within a comfortable limit.

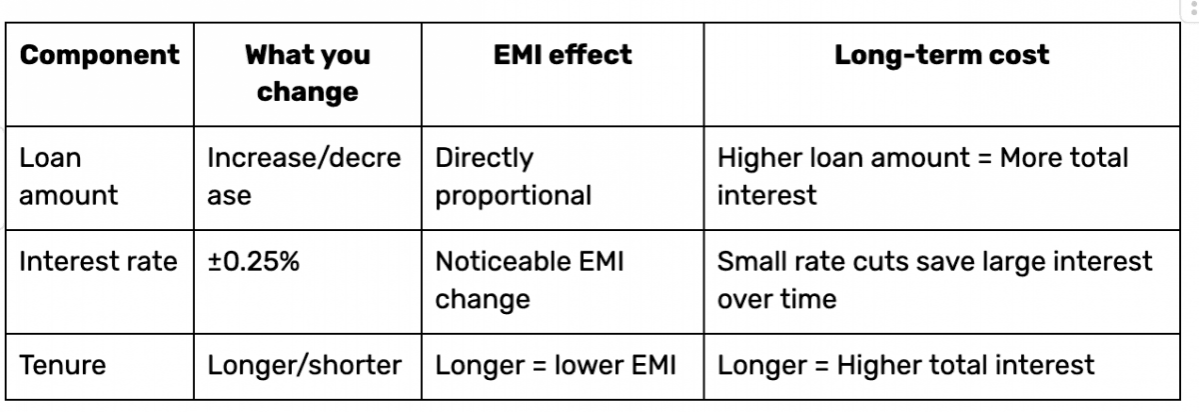

Factors that affect the EMI amount

Even a 0.30% reduction in the home loan interest rate can reduce a few hundred rupees monthly and lakhs over the term. Always double-check your new EMI against the home loan eligibility calculator allowance.

Plan for floating-rate resets

Most loans are repo-linked and reset periodically. When rates rise, lenders usually stretch tenure first. When they fall, they can shorten tenure or reduce EMI. Decide your preference in advance. Many borrowers keep EMI constant and let tenure fall, and this method trims interest faster. Verify both options in your EMI calculator and confirm affordability with the home loan eligibility calculator.

Add prepayments from day one

Early part-payments are most effective because interest is front-loaded in the first few years of the loan. Fix a realistic routine, such as one extra EMI a year or a small lump sum after bonuses, and preview the impact using a prepayment calculator for home loans.

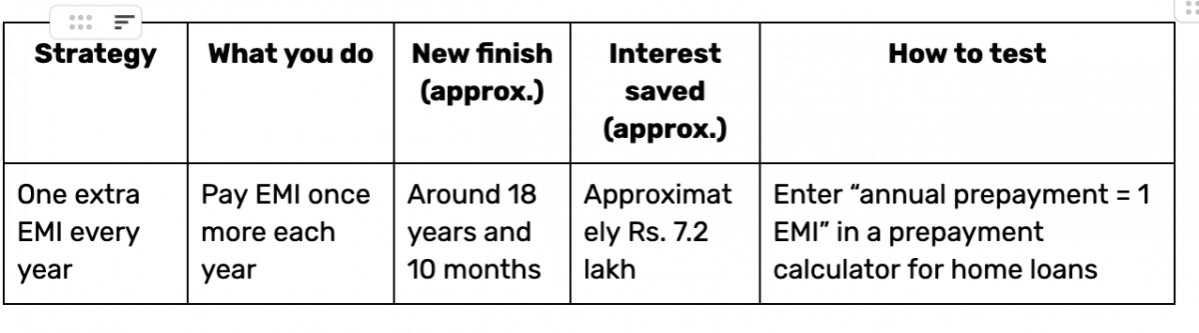

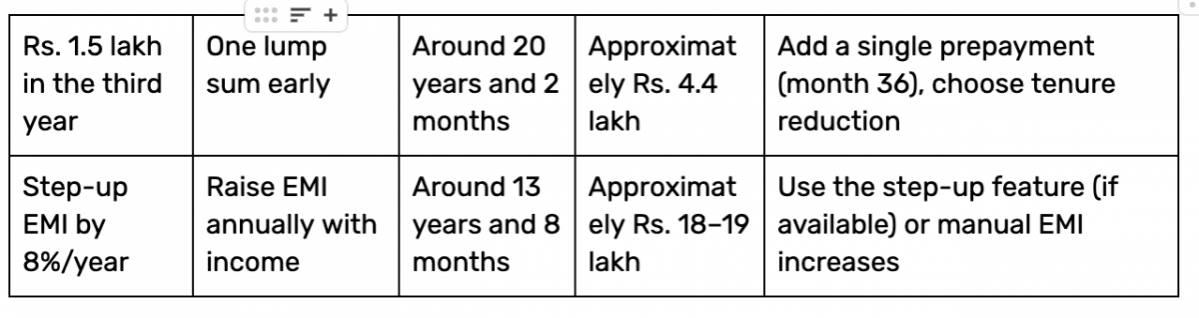

Let us look at a few prepayment scenarios to understand this better:

Note: These figures are only for illustrative purposes. Always validate with your own numbers in a prepayment calculator for home loans.

Tenure cut vs. EMI cut after prepaying

When you part-pay, you can either reduce EMI or reduce tenure. If your cash flow can handle the current EMI, consider opting for a tenure reduction. A prepayment calculator for home loans will show higher total savings with this option.

A simple strategy you can employ

- Know the upper limit: Use a home loan eligibility calculator to find the safe sanction range.

- Find the ideal EMI: Enter loan amount, rate, and tenure in the EMI calculator. Pick an EMI you can pay comfortably.

- Stress test rates: Nudge the rate ±0.25% and see whether you still pass the home loan eligibility calculator affordability test.

- Finalise the down payment: Add Rs. 1–3 lakh to the down payment and check how much EMI drops.

- Schedule prepayments: In a prepayment calculator for home loans, add one extra EMI yearly (Strategy A) and your expected bonus lump sum (Strategy B).

- Lock a step-up: If your income typically grows 6–10% a year, plan an 8% EMI step-up to repay the loan faster.

- Pick your reset rule: At rate changes, choose tenure cut (for interest savings) or EMI cut (for monthly relief), and confirm affordability in the home loan eligibility calculator.

Bottom line

Lead with affordability, not emotion. Let the home loan eligibility calculator set your safe borrowing band, shape your monthly outgo with the EMI calculator, and use a prepayment calculator for home loans to accelerate freedom from debt. When you stress-test inputs, plan small but steady prepayments, and choose tenure cuts at resets, you protect today's cash flow and slash tomorrow's interest, all while keeping your home purchase on schedule.