Companies

Tata Motors' shares dip 3 pc as €2 billion loss from JLR cyberattack may exceed FY25 profit

Hindenburg was a direct challenge to audacity of Indian enterprises to go global: Gautam Adani

Oracle's Larry Ellison becomes world's richest person, surpasses Elon Musk

SpiceJet's stock falls over 5 pc over weak Q1 results

Flipkart hails GST reforms as landmark for digital economy as Big Billion Days near

'Next-Gen' GST reforms to cut healthcare cost, lead towards fit, healthy Bharat: JP Nadda

States to get Rs 10 lakh crore in SGST, Rs 4.1 lakh crore via devolution despite rate rejig

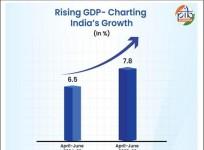

India on track to emerge as 3rd-largest economy by 2030: Govt forecast

India's Q1 GDP growth reflects economy's resilience, says CII's R. Mukundan

Reliance Jio to float IPO in first half of 2026: Mukesh Ambani

Indigo shares decline over 4 pc on promoter offloading stake

Suzuki to invest Rs 70,000 crore in India over next 5–6 years

GST Authority sends tax demand, penalty of over Rs 40 cr to Eternal

Indian airlines report heavy losses in FY25; Air India, Air India Express worst hit

Advertisement

Advertisement