The central government could propose massive benefits to the tax payers in the upcoming interim budget. The measures mooted include lifting income tax exemption threshold from Rs 2.5 lakh to Rs 5 lakh and the re-instatement tax free status to medical reimbursement and travel allowance.

Finance Minister Arun Jaitley could announce the new direct tax tweaks in the interim budget to be presented in parliament on February 1.

Faced with the possibility that a rising tide of middle class resentment can cost it re-election in 2019, the BJP-led government at the centre is on an apparent 'course correction.'

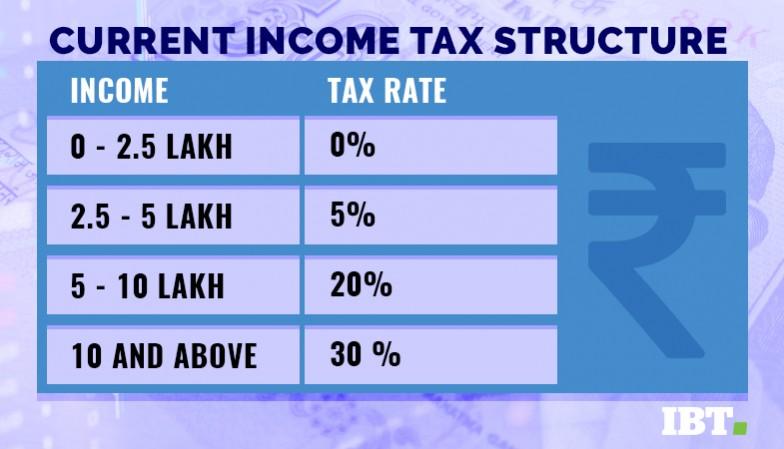

Currently, people who earn above Rs 2.5 lakh per annum are in the tax bracket. Every budget in recent years has raised the spectre of a serious tweak in the lowest taxable threshold but the long pending demand of those at the widest tax-paying bracket has not materialised.

While those in the income group of Rs 2.5 lakh to Rs 5 lakh pay 5 percent in direct tax, those in the next slab -- Rs 5 lakh to Rs 10 lakh -- pay 20 percent in taxes. Income above Rs 10 lakh attracts 30 percent taxes. IANS reports that Jaitley is planning to roll out measures to placate those in the 5 percent and 20 percent tax brackets.

A doubling of tax exemption threshold will be a massive relief measure for those in the lowest rung, who form the bulk of the tax payers.

Widening tax net

At the same time, the re-instatement of the tax-free status for medical reimbursement up to Rs 15,000 and transport allowance up to Rs 19,000 will directly result in a relief of Rs 12,500 annually for the tax payers.

Observers feel that the government might take the bold step considering that it has been able to widen the tax net in the years after demonetisation. In the last two years after the infamous note ban, the government has seen its tax payer base doubling. The number of corporate tax payers has also increased in recent years.

The speculated doubling of income tax exemption threshold could be the ace the government can pull out to douse raging resentment among the middle class and small business owners who were hit by reform measures like demonetisation and the Goods and Services Tax (GST).

The government, aware that an unprecedented cost escalation at the lower rungs of the economy has dented its image, announced a historic 10 percent quota in jobs and education for the poor among the upper castes. While this would win large chunks of people over to the government's fold, the move has also alienated the backward communities and the Dalits.

In another similar move, the GST Council doubled the exemption threshold for small businesses from Rs 20 lakh to Rs 40 lakh.

Multiple challenges

Getting into the re-election mode, the government is grappling with challenges such as rising unemployment, an unprecedented wave of farm distress, high fuel prices credit crunch in the small and medium industries sector and a general weakness in manufacturing.

Though the revision of the income tax slabs will definitely raise the sagging spirit among the middle classes, there are concerns if such a measure would be a breach of conventions. Generally the pre-election interim budgets refrain from making bold policy pitches.

However, Arun Jaitley could argue that the streamlining of the income tax slabs is the precursor to the new Direct Tax Code, which is on the anvil. The Direct Tax Code, which is slated to be unveiled on February 28, is expected to reveal drastic changes in the tax structure and methodologies.