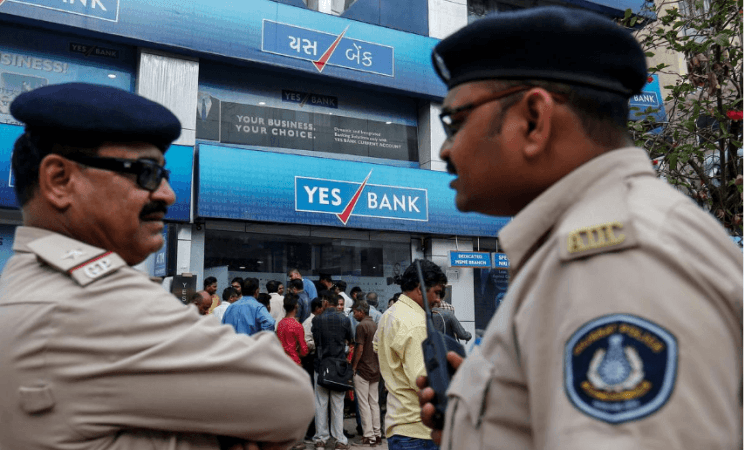

In a major relief to retail depositors, the moratorium on cash-starved Yes Bank will be lifted on March 18 at 6 pm, third day after its reconstruction scheme was notified by the government on Friday evening. Following Yes Bank's inability to raise fresh capital, the Reserve Bank of India superseded its board and placed a restriction on withdrawal beyond Rs. 50,000 till April 3. What followed was long queues of panicked depositors outside the branches of Yes Bank all across the country, similar to what we have already seen in the case of PMC bank.

In a gazette notification on Friday, the government announced, "The order of moratorium on the reconstructed bank issued by the Government of India in the Ministry of Finance, Department of Financial Services vide notification number S.O. 993(E), dated the 5th March 2020 shall cease to have an effect on the third working day at 18:00 hours from the date of commencement of this Scheme."

SBI led rescue plan for Yes Bank

As a part of the turnaround strategy for the beleaguered lender, the State Bank of India (SBI) will buy up to 49% stake in Yes Bank. The state-owned SBI's board had already approved to invest Rs. 7,250 crore in Yes Bank by purchasing 7,250 million shares at Rs. 10 apiece. Moreover, other private lenders including HDFC and ICICI Bank will inject Rs 1,000 crore each, Axis Bank Rs. 600 crore and Kotak Mahindra Bank (KMB) Ltd Rs 500 crore into Yes Bank.

The plan also underlined that SBI cannot reduce its holding below 26 percent for the next three years. Meanwhile, the other investors will be under a three-year lock-in period for 75% of their investment. Further, the authorized share capital of Yes Bank will be revised from Rs 1100 crore to Rs 6200 crore. Similarly, the number of total equity shares has also been changed to Rs 3,000 crore of Rs 2 each. Prashant Kumar has been appointed as the Chief Executive officer and Managing Director of Yes Bank.