In the summer of 2025, the technology world witnessed an audacity few could have imagined. Perplexity AI, barely three years old and valued at $18 billion, announced a $34.5 billion cash bid for Google's Chrome browser, the gateway for over 3.2 billion users worldwide. For context, this was a startup the size of Reddit attempting a takeover nearly as large as Adobe's $35 billion Figma acquisition. In doing so, it challenged not just Google but the very hierarchy of global innovation.

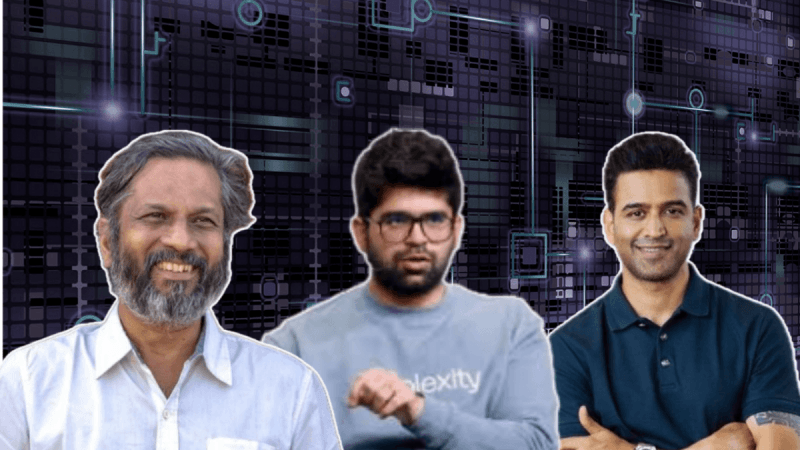

What makes this extraordinary is that Perplexity is not an isolated outlier. In India, Zoho and Zerodha one born in a Tamil Nadu village, the other in a modest Bangalore office have already demonstrated that the future of entrepreneurship does not belong to those with the deepest pockets but to those with the deepest convictions. Together, Zoho, Zerodha, and Perplexity offer a template for the twenty-first century: startups that challenge the scale of Salesforce, SAP, Robinhood, Schwab, Google, Microsoft, OpenAI, and Anthropic without playing by their rules.

Origins: Small Beginnings, Global Ambitions

When Sridhar Vembu started AdventNet (later Zoho) in 1996, Salesforce (founded 1999) was raising millions in Silicon Valley. Today, Salesforce commands 150,000 enterprise clients and $35 billion in revenue; SAP serves 400,000 corporates worldwide. Yet Zoho, built with zero venture capital, now serves 100 million users in 150 countries. Its Zoho One suite costs $37 per user per month a fraction of Salesforce's fees democratizing enterprise software for schools, hospitals, micro-factories, and corner shops. If Salesforce is the software of the Fortune 500, Zoho is the software of the Global 5 million.

In 2010, while Robinhood was still an idea and Charles Schwab already managed trillions, Nithin and Nikhil Kamath launched Zerodha. Today, Schwab's 34 million accounts oversee $9 trillion AUM, Robinhood boasts 23 million funded accounts, but Zerodha entirely bootstrapped handles 12 million Indian investors, representing 15% of India's daily trading volumes. Where Robinhood leans on order-flow payments (~$1.4 billion annually), Zerodha thrives on a simple ₹20 flat fee, proving that transparency scales faster than gimmicks.

Meanwhile, Perplexity confronts the world's most entrenched monopoly. Google owns 90% of the $200 billion global search market; Microsoft, leveraging OpenAI, has clawed back to 8%. OpenAI itself has raised $13 billion from Microsoft, while Anthropic secured $6 billion from Amazon, Google, and others. Against this, Perplexity with just $73 million in funding has redefined the category: not a "search engine" but an "answer engine", where every response carries citations. Its Chrome bid could instantly embed it into the lives of 3 billion users an audacity even OpenAI or Microsoft have not attempted.

Strategies: The Art of Out-Innovating Scale

Zoho thrives by reinvesting 60% of revenue into R&D a proportion three times higher than Microsoft's software reinvestment. Its AI assistant Zia is already deployed by 30% of CRM clients, showing that agility, not size, drives adoption. Microsoft 365 may dominate boardrooms, but Zoho's 55-app suite empowers the underserved segment the world's SMEs, teachers, and family businesses that global giants often overlook.

Zerodha, with just 1,500 employees, executes 10 million daily trades matching Wall Street-grade infrastructure with a tenth of the workforce Schwab requires. Its free financial education platform, Varsity, used by 15 million learners, builds investor loyalty through knowledge, not leverage. It illustrates that in fast-growing economies, trust and literacy are stickier assets than capital inflows.

Perplexity, unlike Google, does not monetize attention with ads. Its revenues come from 1 million Pro subscribers ($20/month) and 10,000 API clients. Its 40% annual subscriber growth already outpaces ChatGPT Pro's early trajectory. In an era where digital trust is scarce, transparency itself becomes a business model.

Scaling: From Villages, Garages, and Lean Offices to Global Impact

Salesforce's market cap stands at $220 billion; Zoho's valuation is a humbler $12.5 billion. Yet by employing 7,000 staff in rural India, Zoho not only saves $100 million annually but pioneers a model replicable in Africa, Southeast Asia, and Latin America. The story here is not cost arbitrage but inclusive innovation—software development that decentralizes prosperity.

Robinhood, valued at ~$10 billion, is still volatile and dependent on Wall Street's sentiment. Zerodha, valued at ₹30,000 crore ($3.6 billion), generates ₹2,500 crore ($300 million) annual profit consistently—something Robinhood has never achieved at scale. In the annals of fintech, Zerodha is the rare outlier that proves bootstrapping can beat billions in venture capital.

Perplexity stands as perhaps the most improbable of the three. While OpenAI and Anthropic burn billions to scale, Perplexity is profitable with minimal funding, positioning itself as the leanest AI challenger in the world. Should its Chrome acquisition succeed, it would be the fastest leap in history: from 5 million to 3 billion users overnight.

Lessons for the Global Boardroom

1. Solve human problems first. Zoho empowers SMEs, Zerodha democratizes investing, Perplexity restores trust in information.

2. Bootstrapping is not a handicap. Zoho and Zerodha show that independence often creates resilience.

3. Lean can outperform fat. Zerodha's 1,500 staff manage a market footprint rivaling Schwab's 35,000.

4. Transparency monetizes faster than scale. Perplexity's clarity wins where Google's opacity erodes trust.

5. Scale with soul. Whether through Zoho's rural labs, Zerodha's investor literacy, or Perplexity's knowledge democratization, these companies prove that purpose can be profitable.

Stories That Redraw the Map

From Tenkasi's dusty roads, to Bangalore's lean fintech corridors, to San Francisco's garages, these ventures illuminate a profound truth: the next global giants may not emerge from venture-funded skyscrapers but from conviction-driven experiments in unlikely places.

Sridhar Vembu built a $12.5B global software firm not from Palo Alto, but from a village lab.

The Kamath brothers redefined brokerage not with complexity, but with a flat ₹20 fee.

Aravind Srinivas now dares to place AI at the heart of 3.2 billion daily searches a move neither Microsoft nor OpenAI has yet attempted.

These are not Indian or American stories alone. They are templates for the world. For boardrooms, policymakers, and entrepreneurs, they remind us that discipline can outlast debt, clarity can outcompete complexity, and trust can outvalue hype.

The incumbents Salesforce, SAP, Schwab, Robinhood, Google, Microsoft, OpenAI, Anthropic may still dominate market caps. But the narratives of tomorrow are being written elsewhere: in rural labs, lean fintech offices, and AI garages.

The only question that remains is: who among us will write the next story?

[Major General Dr. Dilawar Singh, IAV, is a distinguished strategist having held senior positions in technology, defence, and corporate governance. He serves on global boards and advises on leadership, emerging technologies, and strategic affairs, with a focus on aligning India's interests in the evolving global technological order.]

![Ultrahuman launches Ring PRO, free charging case with more than just power and Jade AI [details] Ultrahuman launches Ring PRO, free charging case with more than just power and Jade AI [details]](https://data1.ibtimes.co.in/en/full/829151/ultrahuman-launches-ring-pro-free-charging-case-more-just-power-jade-ai-details.png?w=220&h=135&l=50&t=40)

![Crying, wailing: Shia Muslims in Bengaluru, Lucknow protest killing of Iran's Ayatollah Ali Khamenei [Watch]](https://data1.ibtimes.co.in/en/full/829231/crying-wailing-shia-muslims-bengaluru-lucknow-protest-killing-irans-ayatollah-ali-khamenei.png?w=220&h=138)

![Ultrahuman launches Ring PRO, free charging case with more than just power and Jade AI [details]](https://data1.ibtimes.co.in/en/full/829151/ultrahuman-launches-ring-pro-free-charging-case-more-just-power-jade-ai-details.png?w=220&h=135)