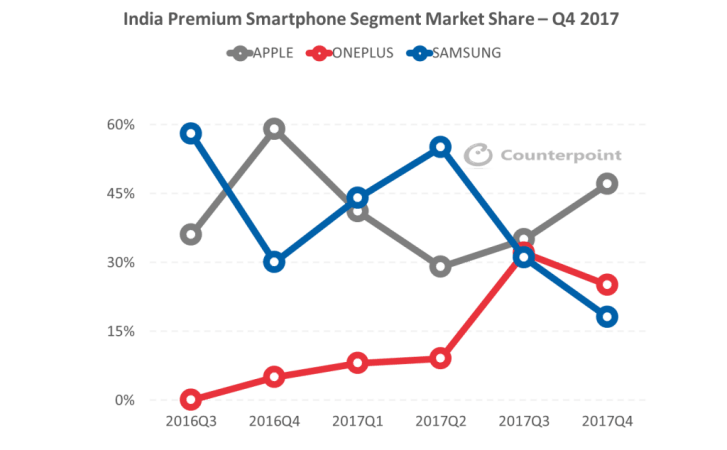

Apple may not be among the top five smartphone vendors in India in the fourth quarter of 2017, but the company has proved once again that it still remains the undisputed player when it comes to the premium segment (above Rs 30,000).

According to the latest data released by Counterpoint Research, the Cupertino-based tech giant captured 47 percent of the premium segment of the Indian smartphone market in Q4 2017, driven by strong shipments of the iPhone X and iPhone 7.

Demand for the iPhone 8, however, remained lower than expected, contributing towards overall shipment drop of 31 percent year-on-year in the premium segment.

The decline in shipments in Q4 2017 was partly due to Apple's stronger quarterly performance in the same period in 2016 when sales of the iPhones spiked due to demonetisation that led to the high volume of cash transactions, the new Counterpoint Research report added.

Strong promotions for iPhone through e-commerce channels (Amazon iPhone fest) and operators (iPhone X with Airtel) also helped Apple remain on top during the three-month period, which witnessed the iPhone X becoming the top-selling premium smartphone, followed by the OnePlus 5T and Samsung Galaxy Note 8.

It's worth mentioning here that no Apple smartphone made it to the top 10 best-selling smartphones in India in the year 2017, which saw yet another Chinese upsurge led by Xiaomi.

As for the premium segment, it was OnePlus that made an impression by becoming the fastest growing brand (over 343 percent) in the subdivision. It was in fact the second successive quarter for OnePlus to rank second in the premium smartphone segment, surpassing Samsung.

Meanwhile, other notable brands like Google, Xiaomi, LG and Nokia also expanded their presence in the premium segment, which saw an annual growth of 20 percent by volume and 28 percent by value in 2017.

"Going forward, we expect the premium segment to continue to grow by more than 20 percent, both in terms of volume and value in 2018, as more brands are likely to enter the segment. These include OPPO, Vivo and Huawei, which have some of their best selling models in China already in this segment," Tarun Pathak, associate director at Counterpoint Research, said in a statement.

"Additionally, the promotional activities in the premium segment are likely to increase, as e-commerce players leverage their scale and promotions to focus on premium smartphones," Pathak added.