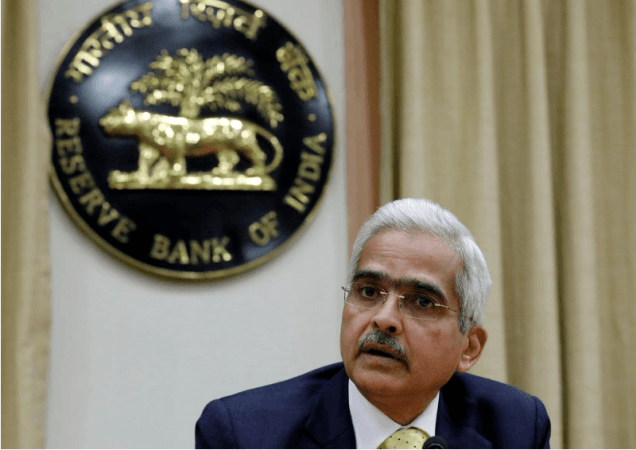

In the wake of the coronavirus crisis in the country, the Reserve Bank of India (RBI) cut its reverse repo rate by 25 basis points from 4 per cent to 3.75 per cent on Friday, April 17. This is the second announcement that Governor Shaktikanta Das made to the media since the nationwide lockdown was imposed from March 25.

In a speech, RBI Governor Shaktikanta Das said the central bank had cut its reverse repo rate to 3.75% with immediate effect, in a bid to push banks to deploy excess funds within the system toward lending, and help revive growth.

"It has been decided to provide special refinance facilities for an amount of Rs 50,000 crores to National Bank for Agriculture & Rural Development, Small Industries Development Bank of India, and National Housing Bank to enable them to meet sectoral credit needs," Shaktikanta Das said to encourage banks to "deploy surplus funds".

The central bank kept its benchmark repo rate unchanged at 4.40%, Das said.

Piyush Goyal on RBI Governor's announcement

Taking to Twitter Union Minister Piyush Goyal said, "RBI Governor's announcement to do "whatever it takes" is a massive confidence booster for the economy. RBI is continuously monitoring the economy to support growth. IMF has also projected India as one of the fastest-growing countries in the current financial year."

"Given the visionary steps taken under the leadership of PM @narendramodiji to protect the lives of the people, today's steps by RBI to support the economy will provide liquidity for growth & help India emerge as a world leader in a post-COVID-19 world," Goyal in another tweet.

(With agency inputs)