Amidst the lockdown due to the coronavirus outbreak, the Reserve Bank of India (RBI) last month had announced a three months moratorium on the repayment on the term loan. The decision meant that a borrower can opt-out of paying the EMI installment during this period and its credit history will also not be affected. The RBI had further clarified that the moratorium would not affect the existing terms and conditions of the loans. But the devil lies in the detail.

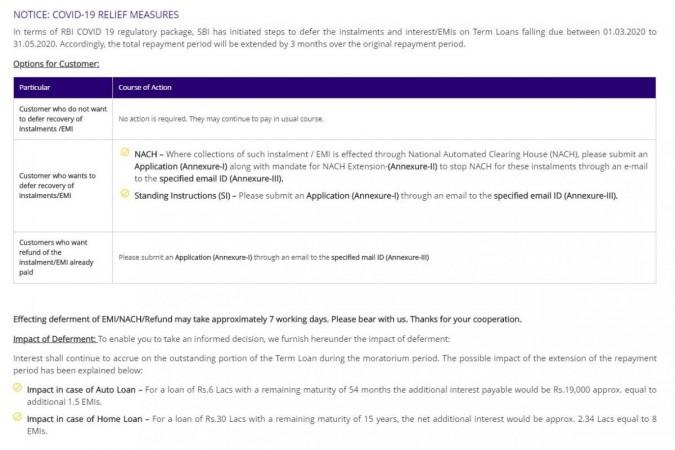

Days after the announcement, scheduled banks today published terms and conditions to avail the facility of the moratorium. As per a report in The Times of India, lenders have overall given three options to the people seeking moratorium. The option may differ banks to banks for generally they have offered three options.

Option A: One-time payment of interest of non-payment in April and May (to be paid in June)

Option B: An interest rate will be added to the outstanding loan and increase EMI for coming months

Option C: EMI will remain unchanged and the tenure will be extended

For example, if a borrower, opts out of paying EMIs for three months for a 30 lakh and has a remaining maturity period of 15, eventually she would end up paying Rs. 2.34 lakh more or 8 additional months of EMI according to her choice of the option mentioned above. Further, the people having older loans taken 10-15 years ago will not be burdened as much as the person has taken loan 2-3 years ago. Moreover, people having older loans may not even need the moratorium as they must have already become financially disciplined in comparison to the people having younger loans.

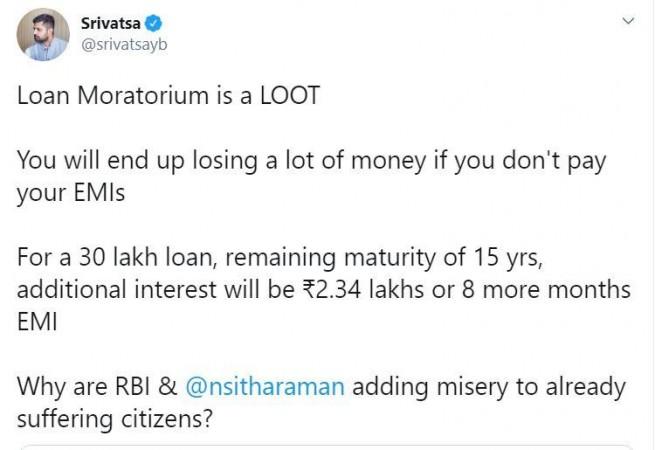

Soon after the details came out in public, many people on twitter heavily criticized the move with some calling it a scam and loot. One of the users wrote, "Loan Moratorium is a LOOT you will end up losing a lot of money if you don't pay your EMIs for a 30 lakh loan, a remaining maturity of 15 yrs, additional interest will be ₹2.34 lakhs or 8 more months EMI. Why is RBI & Nirmala Sitharaman adding misery to already suffering citizens?"