Smartphone sales through online platforms are likely to crash in the March quarter as the revised e-commerce rules came into effect on Feb 1, which restrict heavy discounting, along with several other practices. To limit the impact on overall sales, major handset companies are tying up with brick and mortar stores.

Typically, 30-31 percent of the total smartphone sales in the first two quarters of the year are done through online channels. As revised norms on foreign direct investment in e-commerce take effect, the share of online sales is set to decline to 26-27 percent in the current quarter, according to research firms IDC and Counterpoint Technology Market Research.

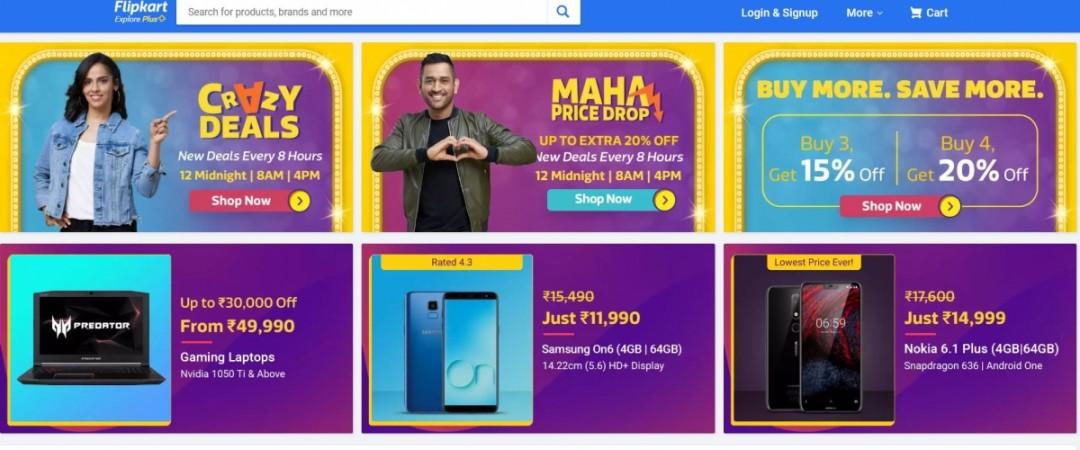

We estimate that around 35% of online sales are triggered due to offers/promotions

and discounts

The new e-commerce norms prohibit online portals from giving preferential treatment to any supplier. The changes have impacted exclusive online launches and deep discounting and

offers.

"We estimate that around 35% of online sales are triggered due to offers/promotions and discounts," Faisal Kawoosa, founder and chief analyst at TechArc told The Economic Times. Handsets companies which rely more on online channels than physical stores are expected to bear the major brunt of the new rules.

The most hurt would be vendors of Honor, Asus and Realme, which are online-only or online-heavy brands, said Prabhu Ram, head, industry intelligence group at CyberMedia Research told the newspaper. These companies have now started forming partnerships with stores such as Reliance Digital and Croma.

Brick and mortar chains to gain

Companies like Realme have hit the road running, adding 10 cities to its offline network in January. The Shenzhen-based smartphone manufacturer plans to add 50 new cities to its network every quarter and add a total of 20,000 stores throughout the country. However, handset makers may find it difficult to expand their offline presence rapidly, Navkendar Singh, associate research director with client devices at IDC, said.

Industry experts expect brick and mortar chains such as Reliance Digital and Croma to gain from the hiccup and command better margins from smartphone manufacturers seeking tie-ups. According to Upasana Joshi, associate research manager, client devices, IDC India, even after the decline, online retailers are set to be sale drivers in 2019, as major platforms are adapting rapidly to the new rules.