Following a record-setting March, the markets opened the financial year 2019-20 (FY20) on Monday with a strong bullish show confirming the technical view of FY20 as a 'buy on dips' market. The general elections whose results are due in the second half of May might induce some volatility, but experts consider the bullish theme to remain through the first half the year.

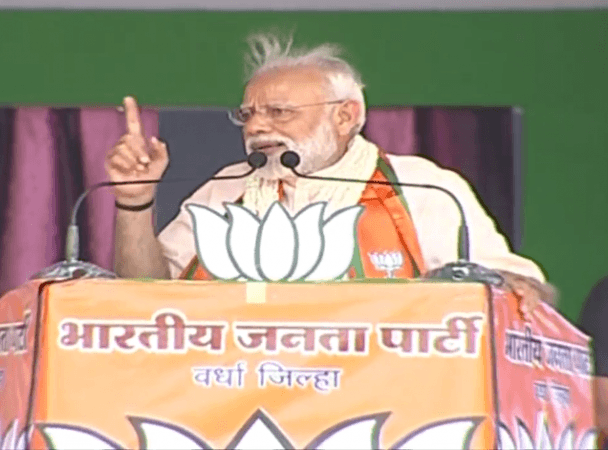

Observers reckon that the prospects of the return to power of Prime Minister Narendra Modi at the helm of a Bharatiya Janata Party (BJP)-led government in Delhi have brightened with the failure of the main opposition Congress party led by its president Rahul Gandhi to attract major alliance partners. Opinion polls by different agencies have given a clear edge to the BJP and the return of a stable government. Rahul Gandhi's decision to contest from Wayanad in Kerala, apart from his traditional Amethi in Uttar Pradesh, has added to the market conviction that the Congress-led United Progressive Alliance (UPA) is not gaining traction in the BJP-dominated states in North India.

A set of global cues including the receding clouds of trade war escalation between the US and China and lessening Brexit confusion is helping global indices and the Indian markets. Wall Street ended the March quarter on a strong note with S&P 500 posting its best quarterly gain since 2009, rising over 13 per cent. The Dow Jones rose 11.2 per cent posting its biggest quarterly rise since 2013, while the Nasdaq soared 16.5 per cent in its best quarter since 2012, a Reuters report said.

A reflection of the general global sentiment was on the show on Monday when the Bombay Stock Exchange's 30-share benchmark Sensex had a strong gap-up opening and set a new high after hitting a lifetime high of 39,028 points surpassing its previous high of 38,989 registered on August 29, 2018. Nifty50 has also been hovering near the record high of 11,760 after making an intra-day high of 11,738 points.

Banking stocks continued their strong show from March into April with Nifty Bank registering a new high of 30,646 points in morning trade with Bank of Baroda, whose amalgamation with Vijaya Bank and Dena Bank created the second largest lender in terms of network and customer base, newly recapitalized Punjab National Bank (PNB), and ICICI Bank.

The spread of the rally across sectors after a gap-up opening to the week points to the market strength that could support a continued rally even in this election quarter, according to some experts. The strong show of banking stocks is believed to be an indication of the market's optimism of another rate cut by the Reserve Bank of India, whose monetary policy committee is set to meet next week.

Market sources attribute the buoyancy to huge buying interest from foreign institutional investors (FII) in the cash segment. FIIs turned net buyers in the quarter with the infusion of more funds, market data show, with fresh fund infusion continuing through the last two consecutive months of the last fiscal year. March alone accounted for a net infusion of Rs 45,981 crore including a net Rs 33,980 crore in equities and Rs 12,001 crore in debt, according to data published by PTI. In February, the overseas players pumped in a net amount of Rs 11,182 crore in capital markets.