In what could mar the Narendra Modi government's Digital India drive, prices of several gadgets, including mobile phones, laptops and desktops are likely to be hiked when the Goods and Services Tax (GST) comes into effect on July 1.

The GST Council has announced that there will be a four-tier tax structure of five, 12, 18, and 28 percent on various categories of goods during its two-day meeting in Srinagar. It has now clear that gadgets mobile phones, laptops and desktops will become dearer when GST is implemented.

Mobile phones that are assembled in India currently fall in 7.5 percent to 8 percent tax category, but it has been raised to 12 percent, which means the prices of handsets Made in India could be hiked. The move could affect domestic manufacturers and consumers as well.

Also read: India Inc reacts to finalisation of GST rates; telecom sector 'disappointed'

"Almost four out of five mobile phones shipped were made in India during Q1 2017. The imposition of the Goods and Services Tax (GST) will have an impact on domestic manufacturing and the government will need to continue incentives for locally manufactured mobile phones to further push the domestic manufacturing ecosystem," Counterpoint Research had earlier pointed out.

Meanwhile, imported phones will get cheaper as the GST Council has fixed duty on them at 12 percent against 17 to 27 percent that was imposed in the past.

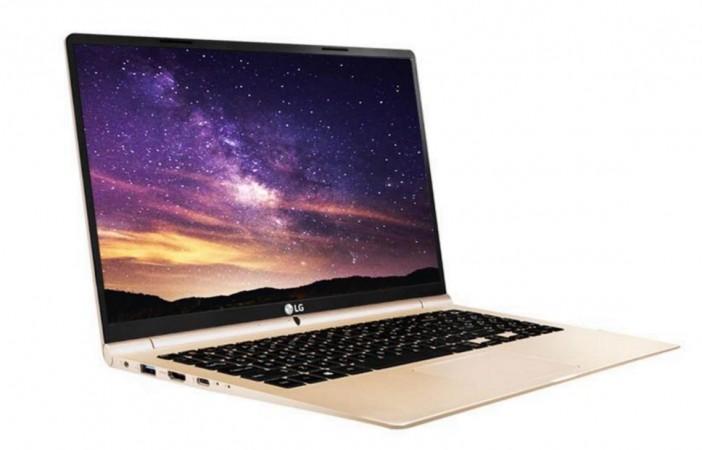

Surprisingly, GST Council hasn't been kind on the laptops and desktops sectors that are already going through a bad phase owing to smartphone growth. These two categories have now been placed in 18 percent tax rate as against the current 14-15 percent. As if that's not enough, products related to laptops and desktops like monitors and printers will fall in 28 percent tax bracket.

The Manufacturers Association for Information Technology had earlier recommended a 12 percent tax rate for computers but the GST Council has raised it instead.