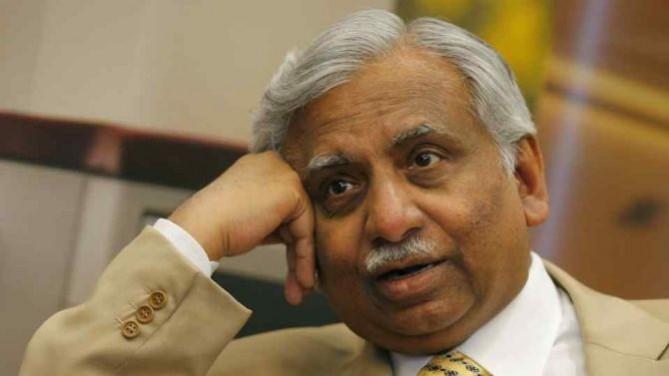

Promoters of the defunct Jet Airways including founder Naresh Goyal may face criminal charges if an ongoing examination of its books reveals financial fraud like diversion of funds that could have been a reason for the crash-landing of India's first private airline, reports suggest. The Registrar of Companies (RoC) inspecting the airline company's books could recommend government action if primary evidence of fund diversion is found, according to a media report.

RoC began examining the books of Jet Airways in August after the company deferred filing its first quarter results for the last financial year (FY19). The government decided to speed up inspection of the books now that the airline, which has a debt of more than Rs 8,500 crore and outstanding payments to vendors service providers of about 2,500 crores, has ceased all operations and the staff have remained unpaid for months. A lenders' consortium led by the State Bank of India (SBI) has invited binding financial bids from four short-listed entities that presented their expressions of interest (EoI) last month.

The company was incorporated in 1992 with Naresh Goyal and children Nivaan and Namrata as promoters and started operating air taxi services in 1993. Jet Airways became India's first private commercial airline by 1995 and soon became the country's largest airline. Jet Airways became a public listed company on December 28, 2004.

Although major shareholders of companies are not liable for business failure, any illegal diversion of fund from the company by the promoters can deprive them of their limited liability, a report in Mint says. The RoC report will recommend if a further investigation into promoters' conduct is warranted. "It could be a detailed investigation by the RoC itself or by any other detective agency," the report said quoting an unidentified person familiar with the development as saying.

![Jet Airways faces an uncertain future as any criminal charges could affect bidders' interest in the investment process. [Representational Image] jet airways](https://data1.ibtimes.co.in/en/full/685232/jet-airways.jpg?h=450&l=50&t=40)

Any criminal investigation into a likely financial fraud could affect the bidding process, aviation sources say, as the bidders would like to wait for clarity about the investigation. The lenders are awaiting by May 10 binding financial bids from the four prospective investors they have chosen. They are United Arab Emirates (UAE) national carrier Etihad Airways, the only airline in the fray, which held 24 per cent stake in Jet before the debt restructuring, US-based private equity firms TPG Capital and Indigo Partners, and state-owned investment fund National Investment and Industrial Fund (NIIF).

Jet Airways founder Naresh Goyal held 51 per cent share in the airline when the crisis struck. Salaries of nearly 20,000 Jet employees are in arrears and many are leaving for rival airlines at lower pays because of the fear that Jet may never fly again. The fleet of the airline that flew about 120 aircraft at one time dwindled to five on April 17 when it grounded all aircraft. The leasing companies took back their aircraft after payment default and fuel suppliers turned off the pipeline. The final blow to the airline has been the government's move to reallot Jet Airways slots to other airlines that were grabbing Jet's idling aircraft and staff.

Following the debt-equity swap that the Jet board approved, Goyal's holding was pared down to 24 per cent and Etihad's 12 per cent. The lenders control about 51 per cent stake and the members of public 13 per cent. The lenders have been offering up to 75 per cent stake to the new bidder.