If you are in the market for a personal finance instrument, the choices out there can be overwhelming. Over the years, just like provisions for taxation, equity-backed savings options, term insurance plans have also evolved to better serve the needs of customers.

Term insurance plans provide comprehensive protection for loved ones in cases of unforeseen events. They provide cover for a fixed time period. In case of death, illness or disability during this period, the insurance company pays the stipulated amount to the beneficiary.

A few decades ago, just about everybody relied on LIC and other state entities for term insurance needs. However, now one can choose from a range of options that are better suited for the needs of modern professionals.

Expectations from a term insurance plan today look quite different from a generation ago; they have evolved to better serve the needs of individuals and their families. Those looking to buy a term insurance plan don't really want to pay a hefty pre mium for a long period of time. One also looks for comprehensive illness coverage and a term insurance partner that will stay true to its promise of paying the claim to beneficiaries when the time comes. One also expects to provide an enhanced quality of life for loved ones.

Though there are a number of options in the market, choosing a term insurance plan that offers the most valuable benefits and best suits your needs is the key.

For the consumer who is looking for a plan that offers comprehensive benefits, Max Life Smart Term is a smart choice. It is a customizable insurance plan that covers one from anything that could get in the way of happiness of loved ones: critical illness, disability or death. Let's take a look at how the plan scores on different parameters.

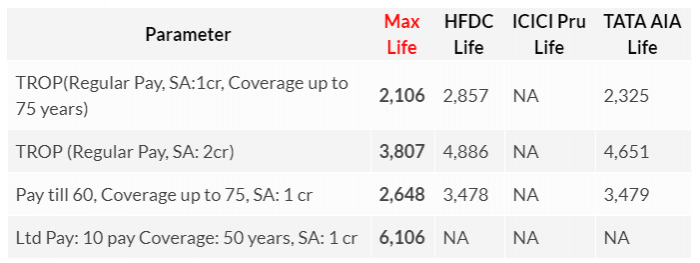

1) Term Insurance Return of Premium (TROP):

Broadly speaking, term insurance plans can be segregated into two types: ones that do not pay back the premium amount and the ones that do. The ones that do are are known as Term Plan with Return of Premium option. With a Term Plan with Return of Premium option, you are covered for the specified term and at the end of the term you get the amount you have paid into the plan. No wonder, Term Plan with Return of Premium option are preferred as they combine financial return along with security for loved ones.

There are several variables that decide whether a short term plan will be a worthwhile financial commitment for you. The most important one is obviously the premium amount you'll be paying.

Apart from this, short term plans have an age limit up to which you are covered. It's important to see that your requirement is met by this age limit. Going for a plan with a 30-year tenure at the age of 40 will secure your loved ones until you reach the age of 70.

Monthly premium is a key aspect of deciding on a term insurance plan. Over several years, even a Rs.100 difference in your premium every month adds up to make a substantial difference. Here's a look at monthly premium amounts from leading insurance providers.

Term Return of Premium (TROP) – Premium Comparison

*Age: 35 yrs; Male- Non-Smoker

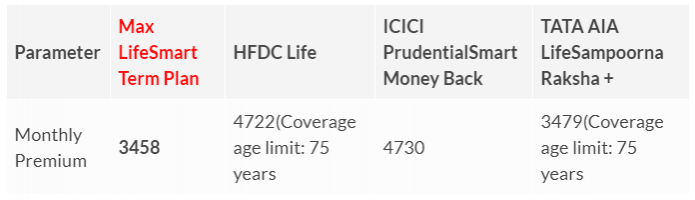

2) Limited pay:

Though there is an option to pay the premium amount at once, plans with regular monthly, quarterly or annual payment options are often preferred as they offer a better hedge against inflation.

With a limited pay option, you can pay a premium for a short fixed span of time to enjoy an extended cover. Thus, you are not obligated to pay the premium over multiple years. This option is especially important for people who anticipate a drop in their current income. With the limited pay option by Max Smart Term Plan, one can get a cover of up to 1 crore until the age of 77 by paying for 15 years.

Term Return of Premium (TROP) – Limited Pay options

*Age: 35 yrs; Male- Non-Smoker

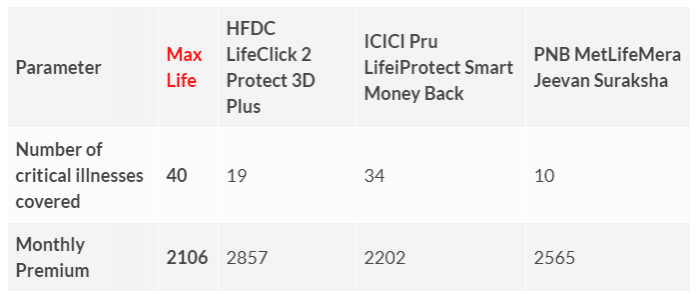

3) Critical illness:

Most term plans offer claim benefits to beneficiaries in case of accidental death as well as critical illness. However, the illnesses covered vary from plan to plan. It's important to know of covered illnesses before choosing a short term insurance plan.

- *Age: 35 yrs. | Male | Non-Smoker

- Regular pay | coverage upto 77 years | 1 crore with return of premium

Smart Term Plan by Max Life offers cover for 40 critical illnesses at a comparable premium.

4) Claims:

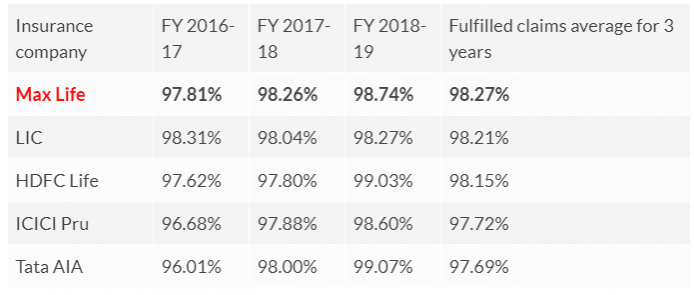

This is a key marker of how your insurance provider stays true to its promise of ensuring the security of your loved ones. Comparing the claims paid by insurance companies can give you an idea of how consistent an insurance provider really is.

Annual claims comparison

Compared to plans offered by other insurers, Max Smart Term Plan has the highest claims average. Additionally, the plan also endeavors to complete claims in a single day with service by a dedicated claims officer.

Thus, on multiple fronts, Max Smart Term Plan is a prudent choice. After all, who doesn't love getting their hard-earned money back?