The week has come to an end, and this week becomes special because the calendar year 2023 ends at the stroke of midnight as well. The week was a four-day affair with it beginning with a trading holiday on account of Christmas.

Markets contrary to expectation gained on three of the four sessions and had a small dip on the very last day of the year. Nothing to be read into but purely coincidental.

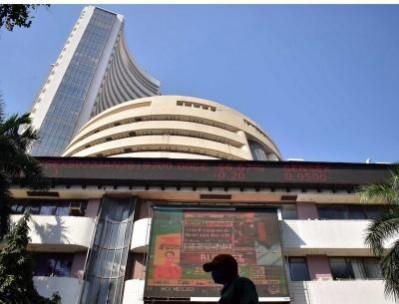

The week saw BSE SENSEX gain 1,133.30 points or 1.59 per cent to close at 72,240.26 points while NIFTY gained 382.00 points or 1.79 per cent to close at 21,731.40 points. The broader markets saw BSE 100, BSE 200 and BSE 500 gain 1.86 per cent, 1.97 per cent and 1.98 per cent respectively. BSE MIDCAP was up 2.67 per cent while BSE SMALLCAP was up 1.60 per cent.

Dow Jones gained in three of the four sessions. It has had a great year and for calendar year 2023 gained 4,484.59 points or 13.53 per cent to close at 37,631.87 points.

In contrast, the Indian benchmark indices have had a great performance and have outperformed the Dow. On a yearly basis, BSE SENSEX gained 11,399.52 points or 18.74 per cent to close at 72,240.26 points.

Similarly, NIFTY gained 3,626.10 points or 20.03% to close at 21,731.40 points. For the week, the Dow was up 303.57 points or 0.81 per cent to close at 37,689.54 points. The rally last year in the markets has been skewed and the bulk of the rally happened in the last couple of months.

The rally in BSE SENSEX was 18.74 per cent of which 26.62 per cent was in the first 10 months and the balance 73.38 per cent in the remaining two months. In the case of NIFTY, the rally in the first 10 months was 26.85 per cent while it was 73.15 per cent in the remaining two months.

Coming to the last week of the calendar year, we saw December futures expire on a positive note. The series fared very well for the bulls and gained 1,645.55 points or 8.17 per cent to close at 21,778.70 points.

US dollar losing its dominance

Moscow, Dec 31 (IANS) The US dollar's share of global central bank reserves has continued to decrease, nosediving to 59.2 per cent in the third quarter of 2023, according to the latest data released by the International Monetary Fund (IMF). The decline comes amid the de-dollarization trend gaining momentum across the globe, RT reported.

The week gone by was the week of new listings and as many as eight listings happened during the four trading sessions. There were three listings each on Tuesday and Wednesday followed by one on Thursday and Friday. There are no IPOs pending as of the date on the main board either to open or list.

The first to list was Motisons Jewellers Limited which had issued shares at Rs 55. The discovered price on BSE on Tuesday was Rs 103.90 and at the end of the day, it closed at Rs 101.18, a gain of Rs 46.18 or 83.96 per cent. By the end of the week, the share had lost further ground and closed at Rs 95.89, a gain of Rs 40.89 or 74.35 per cent.

The second share to list was Muthoot Microfin Limited which had issued shares at Rs 291. The discovered price was Rs 278, a loss of Rs 13 or 4.46 per cent. Shares closed day one at Rs 266.20, a loss of Rs 24.80 or 8.52 per cent. By the end of the week, the share had slipped further to close at Rs 251.20, a loss of Rs 39.80 or 13.67 per cent.

The third share to list was Suraj Estate Developers Limited which had issued shares at Rs 360. The discovered price was Rs 343.80, a loss of Rs 16.20 or 4.5 per cent. The share closed day one at Rs 334.30, a loss of Rs 25.70 or 7.13 per cent. By the end of the week, the share lost further to close at Rs 330.60, a loss of Rs 29.40 or 8.17 per cent.

The fourth share to list was on Wednesday the 27th of December. Shares of Credo Brands Marketing Limited which were issued at Rs 280 listed at Rs 282, a gain of Rs 2 or 0.71 per cent. By the end of the day, they had gained further to close at Rs 312.50, a gain of Rs 32.50 or 11.60 per cent. By the end of the week, the share lost some ground and closed at Rs 292.40, a gain of Rs 12.40 or 4.43 per cent.

The fifth share to list was RBZ Jewellers Limited. The share debuted on day one at Rs 100 and closed at Rs 104.99. By the end of the week, the share had gained further and closed at Rs 115.74, a gain of Rs 15.74 or 15.74 per cent.

The sixth share to list was Happy Forgings Limited which had issued shares at Rs 850. The discovered price was Rs 1001.25, a gain of Rs 151.25 or 17.79 per cent. By the end of the week, the share closed at Rs 1,029.10, a gain of Rs 179.10 or 21.07 per cent.

The seventh share to list was from Azad Engineering Limited which had issued shares at Rs 524. The discovered price was Rs 710, a gain of Rs 186 or 35.49 per cent. Share closed day one at Rs 677.10, a gain of Rs 153.10 or 29.21 per cent. share closed the week at Rs 692.40, a gain of Rs 168.40 or 32.13 per cent.

The eighth and final share to list was Innova Cap Tab Limited which had issued shares at Rs 448. The discovered price was Rs 456.10, a gain of Rs 8.10 or 1.80 per cent. Share closed day one at Rs 545.15, a gain of Rs 97.15 or of 21.68 per cent.

It appears that investors who do intraday trading in newly listed shares have gotten caught on the wrong foot in the Innova Cap Tab.

Further, in some of the listings, the grey market premiums have just disappeared post the issue getting subscribed. Probably it's time to take a fresh look at grey market premiums and their reliability.

Of the eight listings last week, two of them are trading at a discount to the issue price.

Coming to the year, month and week ahead, expect markets to trade in a more circumspect manner. We have seen the best of the markets in the short term and one should expect that January would be a month of sideways movement and correction. There would be no budget on February 1 as this is the election year and there would be a vote on account to take care of government expenditure.

The biggest driver for markets would be the quarterly corporate results for the October-December quarter which would begin in the second week of January. Market men are also hoping that FPI buying will continue.

The strategy would be to look to take some money off the table, particularly from the smallcap and midcap space. Sell into rallies and wait for really deep cuts to re-enter. Trade cautiously.

(With inputs from IANS)