Time's up. The United Arab Emirates had loaned Pakistan $1 billion and the deadline to return the money was set at March 12, 2021. As agreed, UAE is now demanding its money back as it has reached its maturity. This has caused panic in the Pakistan leadership as the country is not in a position to repay.

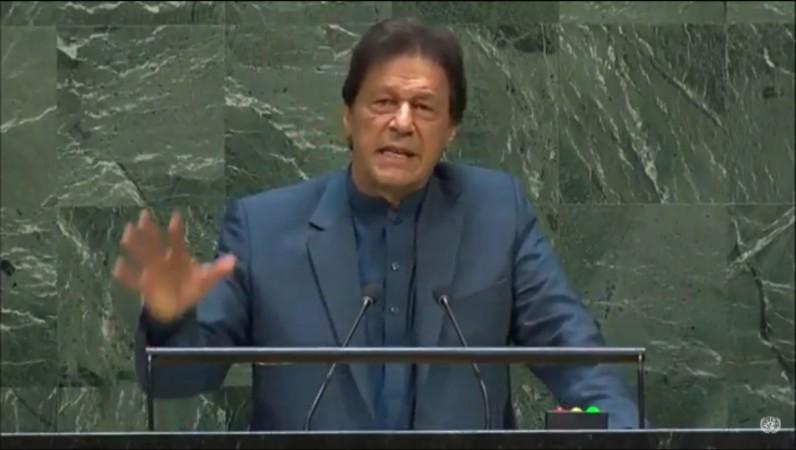

According to several media reports, top officials of the Pakistan government have made several attempts to reach out to UAE's Crown Prince Mohammed bin Zayed Al Nahyan, but to no avail. Pakistan PM Imran Khan and co is believed to have pleaded for a possible extension and expressed concerns about a huge impact on its economy due to such a huge amount.

Pakistan's economy is already in a dwindled state. The country's real GDP growth is estimated to have declined from 1.9 percent in FY2019 to -1.5 percent in FY2020, Wion reported.

Pakistan, debts and terrorism

Pakistan's credit score isn't something worth boasting. Earlier this year, Pakistan and International Monetary Fund (IMF) reached a staff-level agreement to release $500 million as part of a larger loan pact. According to the latest development, the IMF is likely to revive the stalled loan programme on March 24. If the meeting goes as planned, Pakistan could get its third loan tranche of $500 million, bringing the total to $2 billion out of the $6 billion programme.

Despite neck-deep in debts and unable to repay, Pakistan is not willing to give up its terror activities. Union Minister of State for Home, G. Kishan Reddy, on Wednesday said the government has consistently pressed Pakistan to put an end to cross-border infiltration of terrorists and dismantle the infrastructure supporting terrorism on a permanent basis. But Pakistan continues any terrorist training camps in occupied Kashmir and using them to push terrorists into Indian territories.