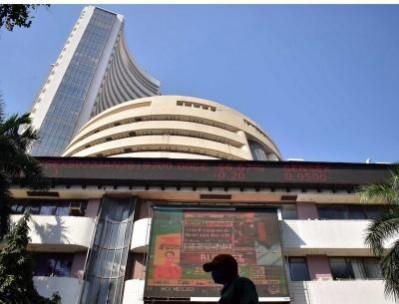

Auto and IT stocks are in the limelight as the BSE Sensex traded up more than 500 points on Friday. The Sensex is well past the 64,000 mark and breaching new highs on strong global cues.

Among the Sensex stocks, M&M and Indusind Bank were up more than 3 per cent. Sun Pharma, Infosys, Maruti, TCS were up more than 2 per cent each.

Since valuations are rich from the short-term perspective some profit booking can be considered by investors who do not have a long-term time horizon, says V. K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Investors should remain invested in the market. Long-term investors can continue with their systematic investments. High quality financials are even now trading at fair valuations, he added.

The momentum in the market has picked up again and the undercurrent has the potential to take the benchmark indices to new highs. The global support to the bullishness is coming from the mother market US where the market is resilient supported by better-than-expected Q1 GDP growth of 2 per cent and declining weekly jobless claims, he said.

This resilience of the US economy, which was not anticipated and discounted by the market, is the strongest pillar of support for the global markets now.

In July the market trend will be influenced by auto sales numbers in June, Q1 results, progress of the monsoon and the Fed rate decision and commentary by month end.

Market valuations are rich now, and therefore, investors should exercise some caution, he added.

(With inputs from IANS)