The Indian stock market rose on Monday morning with the BSE Sensex gaining over 200 points. Rise in the shares of index-heavyweights Reliance Industries and ICICI Bank lifted the index.

Around 10.15 a.m., Sensex was trading at 52,631.44, higher by 245.25 points or 0.47 per cent from its previous close of 52,386.19. It opened at 52,634.33 and has touched an intra-day high of 52,685.90 and a low of 52,568.92 points.

The top gainers on the Sensex were UltraTech Cement, ICICI Bank and Maruti Suzuki India, while the major losers were Bajaj Finserv, Bharti Airtel and Hindustan Unilever. The Nifty50 on the National Stock Exchange was trading at 15,760.65, higher by 70.85 points or 0.45 per cent from its previous close.

Manish Hathiramani, technical analyst with Deen Dayal Investments said: "The Nifty has bounced from Friday's low and is once again trading around the midpoint of the range which is 15,400-15,900. If we can scale higher and get past 15,900, we should be able to achieve 16,100. Until then trading is going to be lackluster with tepid volumes."

FPIs stage major exit in July

Foreign Portfolio Investors (FPI) have been net sellers in the Indian equity segment so far in July. They have withdrawn net investments worth Rs 2,249 crore from the equities in July, showed data on the NSDL site.

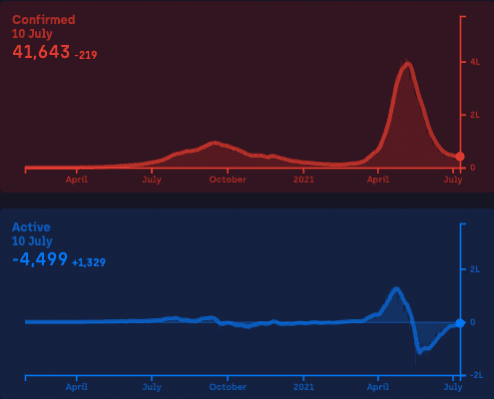

The concerns over the 'Delta' variant of Covid-19 and rising oil prices have weighed on the investor sentiments, analyst said. With net outflow so far in this month, the net FPIs investments in 2021 stands at Rs 58,095 crore. In June, net investment into the equities segment stood at Rs 17,215 crore.

Kotak Securities' Executive Vice President, Equity Technical Research, Shrikant Chouhan, said: "FPIs have been net seller in Indian equities in July 2021 till date. All key emerging markets and Asian markets have seen FPI outflows this month to date."

"We expect FPI flows to India to remain vulnerable to US Fed monetary policy and rising crude oil prices. Markets going ahead will keep a watch on inflation, oil prices, bond yields and spread of Covid Delta variant," he said.