Reliance Jio's growth in telecom industry has been phenomenal, thanks to its disruptive strategy of free unlimited 4G data to its subscribers for three months as an introductory offer. It is now the top wireless broadband service provider in India.

According to Telecom Subscription Data as on 31st May, 2017 published by Telecom Regulatory Authority of India (TRAI), Reliance Jio tops the list of wireless broadband service providers in the country with 117.34 million subscribers, followed by Bharti Airtel (51.21 million), Vodafone (40.42 million), Idea Cellular (24.63 million) and Reliance Communications (14.46 million).

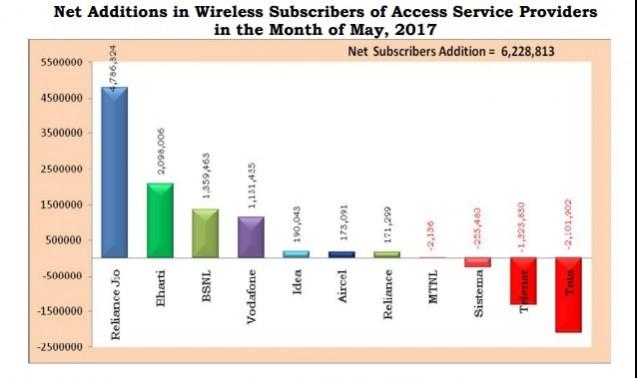

Reliance Jio also leads the growth in wireless subscribers, recording a net addition of 4.7 million new customers in the month of May, followed by Bharti Airtel with an addition of 2.09 million customers, BSNL (1.35 million), Vodafone (1.13 million), Idea Cellular (0.19 million), Aircel (0.17) and Reliance Communications (0.17). The total net subscriber additions in the mobile services segment in May was 6.23 million.

Tata Teleservices was the biggest casualty with a 2.1 million loss of subscribers, followed by Telenor (1.32 million), Sistema Shyam (0.25 million) and MTNL (2,136).

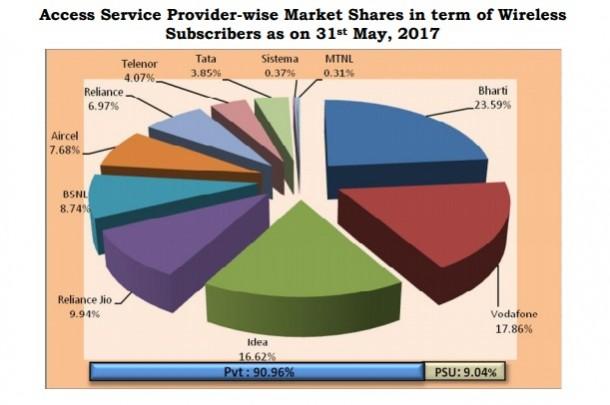

As on May 31, the private access service providers held 90.96 percent market share of the wireless subscribers whereas BSNL and MTNL had a market share of only 9.04 percent, according to Trai.

TRAI report said top five service providers constituted 88.23 percent market share of the total broadband subscribers at the end of May, and they were Reliance Jio Infocom Ltd (117.34 million), Bharti Airtel (53.30 million), Vodafone (40.43 million), Idea Cellular (24.63 million) and BSNL (21.59 million).

The report said BSNL leads the top five wired broadband service providers with 9.80 million consumers, followed by Bharti Airtel (2.09 million), Atria Convergence Technologies (1.20 million), MTNL (0.99 million) and YOU Broadband (0.64 million).

Total number of telephone subscribers in India

The number of telephone subscribers in India at the end of April was 1,198.89 million and it increased to 1,204.98 million at the end of May, showing a monthly growth rate of 0.51 percent. The subscription in urban areas increased from 695.99 million to 697.06 million (0.15 percent), while the rural areas witnessed an increase from 502.90 million to 507.92 million (1.00 percent) during the same period.

Total wireless subscribers increased from 1,174.60 million at the end of April to 1,180.82 million at the end of May, registering a monthly growth rate of 0.53 percent, and 1,019.55 million of them were found active in May. The wireless subscription in urban areas increased from 675.48 million to 676.65 million (0.17 percent month growth), whereas rural areas witnessed an increase from 499.12 million to 504.18 million (1.01 percent month growth), during the same period.

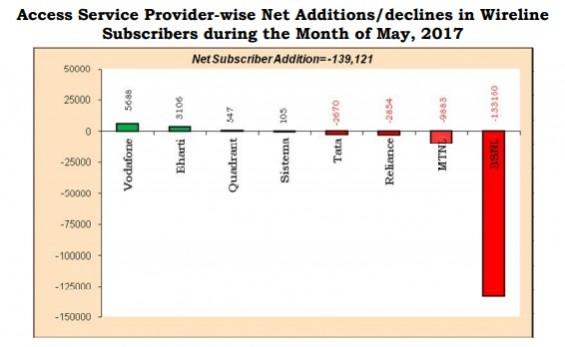

The number of landline subscribers declined from 24.30 million at the end of April to 24.16 million at the end of May. BSNL was the biggest casualty with a loss of 0.13 million landline customers, followed by MTNL (9,883) RCom (2,854) and Tata Teleservices (2,670). Meanwhile, Vodafone witnessed an increase of 5688 subscribers, followed by Airtel (3106), Quadrant (547), and Sistema (105).

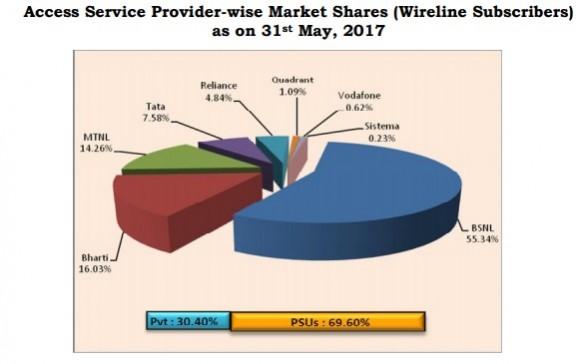

However, state-owned BSNL still leads the wireline market share with a 55.34 percent, followed by Airtel with 16a 16.03 percent, MTNL (14.26 percent), Tata (7.56 percent), Reliance (4.84 percent), Quadrant (1.09 percent), Vodafone (0.62 percent), and Sistema (0.23 percent).