Reserve Bank of India's Monetary Policy Committee (MPC) on Wednesday cut repo rate by 25 basis points (bps) to six percent, the lowest in last seven years, primarily due to a steeper-than-anticipated fall in inflation and maintained a neutral policy stance.

Of the six-member MPC, four members voted in favour of 25 bps cut, one member voted for 50 basis points cut and one voted for status quo.

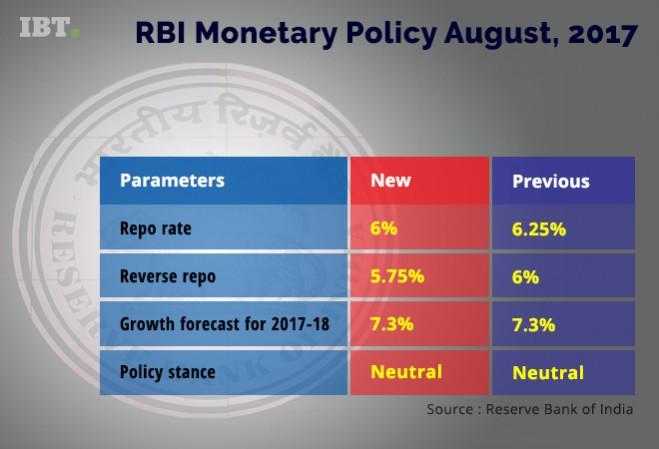

Following the decision, the benchmark repo rate stands reduced to six percent from 6.25 percent earlier. Accordingly, the reverse repo rate has been pegged down to 5.75 percent from previous six percent.

The central bank has made no changes in its projections for the current fiscal. The forecast for gross value added growth for the fiscal 2017-18 has been maintained at 7.3 percent.

"Consequently, some space has opened up for monetary policy accommodation, given the dynamics of the output gap. Accordingly, the MPC decided to reduce the policy repo rate by 25 basis points. Noting, however, that the trajectory of inflation in the baseline projection is expected to rise from current lows, the MPC decided to keep the policy stance neutral and to watch incoming data. The MPC remains focused on its commitment to keeping headline inflation close to 4 percent on a durable basis," the monetary policy statement said.

Factors leading to rate cut

What allowed the central bank's MPC to relax rates is the recent drop in retail inflation. Consumer inflation fell to 1.54 percent in June, taking it to below the RBI's minimum threshold of three percent, BloombergQuint reported.

The economy continues to be held back by a lack of private investment. This is unlikely to change in a hurry since capacity utilisation remains close to 75 percent. Private investment tends to pick up only after capacity utilisation breaches the 80-85 percent mark. Lower rates will create a big push to investment.

Another factor while considering the need for a rate cut is the liquidity in the market. Against the backdrop of surplus liquidity, the RBI has been absorbing funds from the market through open market operations (OMOs). Cutting rates at a time when the regulator is absorbing liquidity may give conflicting signals to the market.

Finally, the mounting of stressed assets in the banking sector may also play a role in the RBI's rate decision. RBI deputy governor Viral Acharya had noted that slightly higher rates may be justified at a time when bank balance sheets are weighed down by stressed assets.

Global factors

One of the key reasons for the rate cut is because of the supportive global factors. The US Federal Reserve is expected to soon start shrinking its balance sheet, while similar unwinding measures, taken to boost growth, are discussed in the euro zone. These factors can have a direct impact on the currency market and rupee could see bouts of volatility. A rate cut will bring down the interest rate differential, which currently is on the higher side, Mint reported.

Impact on Market

The stock market has already celebrated the possibility of a rate cut over the past few weeks after the retail inflation print for June came in at a record low of 1.5 percent. In fact, a hawkish outlook by the RBI could spark a sell-off in bank shares. Position build-up in Bank Nifty options contracts due for expiry this Thursday, suggests the index is not likely to gain more than 2.7 percent from Friday's close.