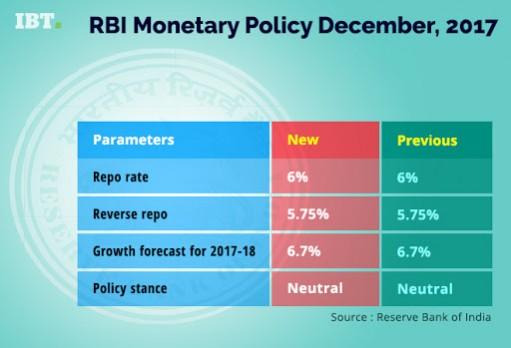

As anticipated by the market participants, Reserve Bank of India's Monetary Policy Committee (MPC) led by RBI Governor Urjit Patel on Wednesday chose to maintain the status quo by keeping the repo rate unchanged at 6 percent.

Following the decision, the benchmark repo rate stands at 6 percent, and the reverse repo rate remains unchanged at 5.75 percent and the central bank maintained a neutral policy stance.

Of the six-member MPC, five members voted in favour of status quo, while Ravindra Dholakia voted in favour of 25 basis point cut in rates.

The MPC said that the neutral stance of monetary policy is in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 percent within a band of +/-2 percent while supporting growth.

While announcing the decision, noting several risks to inflation, the MPC increased its inflation projection marginally by 10 bps for the ongoing fiscal. It now expects inflation to range between 4.3-4.7 percent for the next two quarters of the current fiscal, previously the central bank projected it at the range of 4.3-4.6 percent.

"...the MPC decided to keep the policy repo rate on hold. However, keeping in mind the output gap dynamics, the MPC decided to continue with the neutral stance and watch the incoming data carefully. The MPC remains committed to keeping headline inflation close to 4 percent on a durable basis," RBI Monetary policy statement said.

The monetary committee maintained its forecast of 6.7 percent GVA growth for the current year, but noted that the second quarter growth was weaker than it had anticipated.

"There has been some pick up in credit growth in recent months. Recapitalisation of public sector banks may help improve credit flows further. While there has been weakness in some components of the services sector such as real estate, the Reserve Bank's survey indicates that the services and infrastructure sectors are expecting an improvement in demand, financial conditions and the overall business situation in Q4," the policy statement stated.

Last week, data released by the Central Statistics Office (CSO) showed that India grew at 6.3 percent for the quarter ended September, from its three year low of 5.7 percent in last quarter, as businesses adjusted to the new GST tax regime.

Of the three top rating agencies, Moody's Investors Services, Fitch Ratings and Standard & Poor's (S&P), only Moody's upgraded India's credit rating, S&P maintained status quo and now Fitch Ratings downgraded.

Last month the government said it will recapitalise state-owned lenders with Rs 2.11 lakh crore over the next two years, which was appreciated by economists, former central bankers and rating agencies.

On Wednesday, the Indian rupee opened slightly weak against the US dollar. The rupee opened at 64.47 a dollar, currently trading at 64.44 a dollar, down 0.10 percent from its Tuesday's closing.

Foreign institutional investors (FIIs) turned buyer for past two months, as they pumped in Rs 3,055 crore in October and Rs 19,728 crore in November. However, in December FIIs pulled out Rs 599 from the Indian market.

Following the monetary policy meeting, the capital market reacted negatively, with the benchmark BSE Sensex is down by around 210 points while Nifty 50 index is down 78 points.