The Reserve Bank of India (RBI) came out with a scheme of reconstruction or amalgamation for troubled YES Bank on Friday, March 6.

What the Scheme of Reconstruction reads:

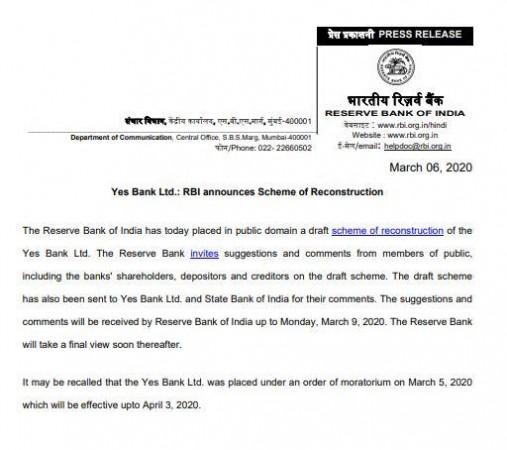

"The Reserve Bank of India has today placed in the public domain a draft scheme of reconstruction of the Yes Bank Ltd," the RBI statement said.

The Reserve Bank has invited suggestions and comments from members of the public, including the banks' shareholders, depositors and creditors on the draft scheme.

READ: Have an account with Yes Bank? Here's what you can do

"The draft scheme has also been sent to Yes Bank Ltd. and State Bank of India for their comments. The suggestions and comments will be received by Reserve Bank of India up to Monday. March 9. 2020. The Reserve Bank will take a final view soon Thereafter. It may be recalled that the Yes Bank Ltd was placed under an order of moratorium on March 5. 2020 which will be effective up to April 3. 2020," the RBI said in a statement.

SBI to rescue Yes Bank?

The State Bank of India (SBI) has stated that it wants to make an investment in the Yes Bank and participate in its reconstruction scheme. "Will take a call on Yes Bank after the Reserve Bank of India (RBI) plan is in," Rajnish Kumar told reporters after meeting Finance Minister Nirmala Sitharaman.

READ | SBI chief meets FM Sitharaman over Yes Bank crisis: 'Will take a call after RBI plan is in'

Yes Bank was placed under 30-day moratorium by the RBI and the withdrawal limit has been capped at Rs 50,000 for depositors on March 5. The bank will remain under withdrawal restrictions until April 3, 2020.

Your money is safe, says FM Sitharaman

Finance Minister Nirmala Sitharaman has assured the Yes Bank depositors that their money is safe. "In touch with RBI on the Yes Bank crisis," Sitharaman told reporters.

"I want to assure all the depositors that their money is safe, I am constantly in touch with the Reserve Bank of India (RBI). The steps that are taken are in the interest of the depositors, the bank & the economy," Sitharaman stated.