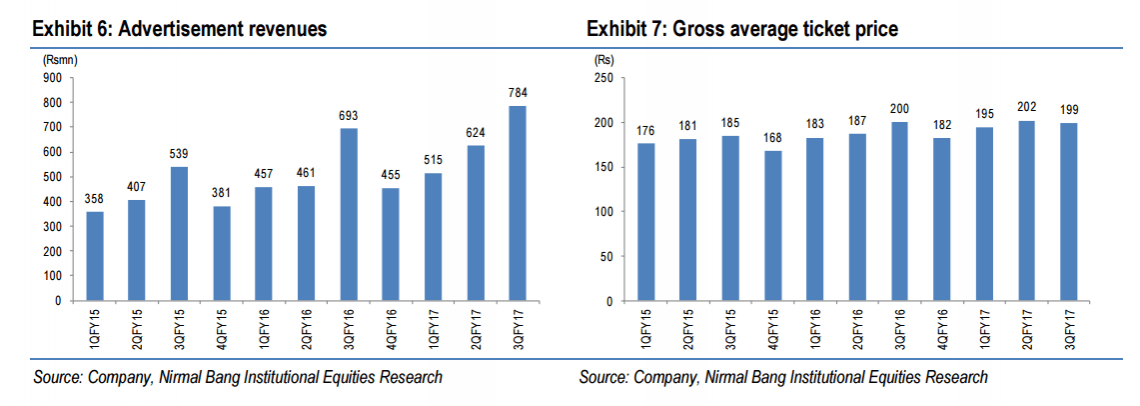

PVR, a film entertainment company that owns 559 screens (as of December 31, 2016), put up a not-so-good show during the third quarter (Q3) ended December 2016, thanks to demonetisation. Net profit fell 21.7 percent YoY to Rs 23.5 crore, while revenues rose 7.4 percent YoY to Rs 537 crore; on a sequential basis, net profit and revenues declined 19.3 percent and three percent, respectively. Hindi films that dominated Q3 include Aamir Khan's Dangal while PVR's revenues are expect to buoy with movies like Raees and Kaabil.

The PVR stock was trading at Rs 1,269 on Tuesday at around 12.05 pm on the BSE.

Read: Raees box office collection day 13 crosses Rs 150 crore

Kaabil Day 12 box office collection crosses Rs 150 crore gross mark

Some of the key parameters grew either at a lower clip when compared to the September 2016 (Q2) quarter or declined due to the impact of the note ban imposed by the Narendra Modi government on November 8, 2016 that led to a cash crunch among people.

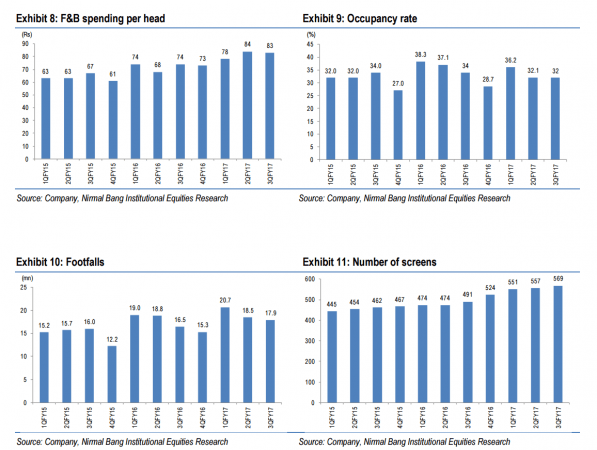

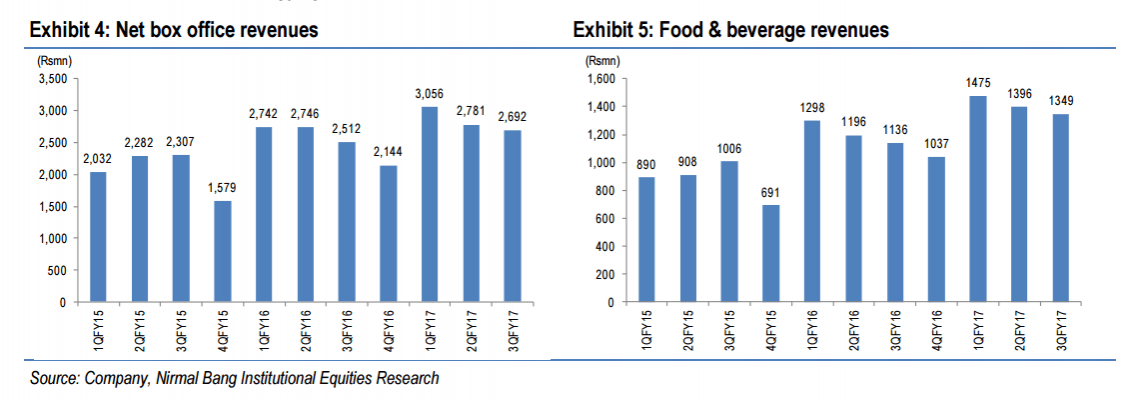

Brokerage Nirmal Bang Institutional Equities, in its analysis of PVR's Q3 results and the subsequent earnings call, said net box office revenues, income from food and beverages and occupancy rate showed a drop, while advertisement revenues grew, both YoY and sequentially.

Footfalls, or the number of movie-goers, also fell to 17.9 million in Q3 in comparison to 18.5 million in September 2016 quarter, confirming the flip side of cash crunch. The impact will be felt less due to a shift in ticket-buying pattern. Compared to 45 percent of tickets being booked using cash pre-demonetisation, the same now is 25 percent, Nirmal Bang said, after the earnings call with the PVR management.

Here are the key takeaways from the conference call, according to Nirmal Bang:

- Revenue growth of 7.4 percent YoY in 3QFY17 of PVR was a tad above our expectation which we had trimmed on 6 December 2016 post demonetisation.

- Net box office collections, however, declined 7% on a comparable property basis reflecting the two to three weeks' 20-25 percent decline in footfalls post demonetisation and release of poor content through most of the quarter.

- Occupancy rate at 32 percent in Q3 was better than estimated. Average ticket price (ATP) was down 2 percent for comparable screens and spending per head (SPH) on food and beverages grew 8 percent YoY as against 18 percent growth in Q2, FY17.

- PVR is currently the largest multiplex operator in India (~26% share of screens, 30% and 22% share of Hollywood and Bollywood box office revenues, respectively).

- On 4QFY17, PVR expressed confidence about its prospects because of continued good performance of Dangal (for Dangal, it crossed gross box office collection - GBOC - of Rs1 billion for the first time for any movie in its history) and the good performance of Raees and Kaabil till date and the likely release of films like Jolly LLB – 2; Badrinath ki Dulhania; Rangoon and Sarkaar – 3.

- On demonetisation, PVR expressed hope that ATP will grow at the rate of inflation in the coming quarters because of its higher presence in urban and semi-urban areas (~60% of screens in Tier-1 cities) where digital mode of payment is more prevalent.

- PVR currently pays 27-28 percent tax on tickets and 10-11 percent on F&B which combine to an blended tax rate of about 23 percent.