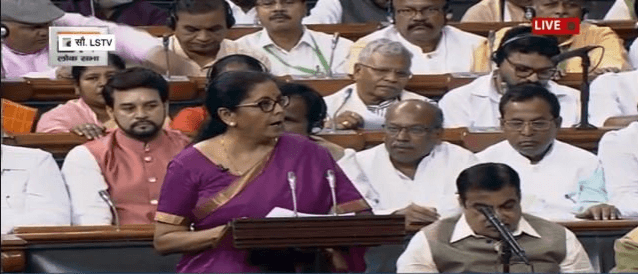

Union Finance Minister Nirmala Sitharam in her maiden budget speech pondered the miniscule number of 3.7 crore income tax payers in India, a nation of 132 crore people figuring just below China in terms of the world's most populous country.

Ironic but the tax payers' size at 3.7 crore is nowhere near the number of voters registered in our country at 82 crore, indicating the strong political narrative undermining the plea of economists and accountants to make it broad-based and more compliant. Currently, 3.3 percent of Indian population is filing Income Tax returns (ITR), which is far less compared to 8 percent in China.

In her buget speech, Finance Minister Nirmala Sitharaman, like many of her predecessors, reiterated the wider belief that ours is essentially a 'non-compliant' society in terms of payment of taxes. But the truth is that ours is hugely a 'subsidised' nation where agriculturists, forming the biggest chunk at 75 percent of the population, are availing the tax exemption citing the agricultural income.

In sheer numbers, these agriculturists constitute a whopping 61.5 crore and many of them buy cars, bungalows and any luxury item like other tax payers in India. Next comes the other segment of people who really fall 'Below the Poverty Line' and they constitute 24 percent of the population or 20.5 crore, whose exclusion is never questioned in a developing country like ours.

Finally, the tax authorities are left with 15 crore population, who come under non-agricultural or non-BPL category. But not all of them are paying taxes as other exclusions such as Senior Citizens, non-working housewives, unemployed youth, and below taxable income earners come into play.

The typical Indian family has one bread winner and five to six dependants, whether children or aged parents or a housewife. With the middle-class values still persisting through the average Indian family, we cannot reverse the situation overnight and the Indian chartered accountant organisations have put this figure at 11.5 crore. Hence, our income tax payers' base remained still at just 3.75 crore, as it is now.

As the past experiments such as demonetisation and rampant scrutiny and IT raids evinced little progress in widening the tax net, the next best alternative is to widen the tax net, bringing the agriculturists into it gradually. Since, doubling the number of tax payers never doubles the tax revenue, selective inclusion and exclusion policy is the need of the hour.

In fact, many people, citing the agricultural income, evade the income tax, while those paying higher tax regularly face the prospect of further taxation in every budget. Even a token amount of tax on rich farmers by amending the exemption clause under Section 10 (1) of the Income Tax Act of India will bring 26 percent of this segment into the direct tax net.

The choice for the Finance Minister is either to widen the Income Tax net or abolish it entirely, since indirect tax, say GST, in already in place. In fact, Prime Minister Narendra Modi had pitched this idea during the 2014 Lok Sabha elections. If feasible, this could save many pockets. Other tax avenues such as inheritance tax can also be explored, instead of repetitive taxation slabs at the higher end.