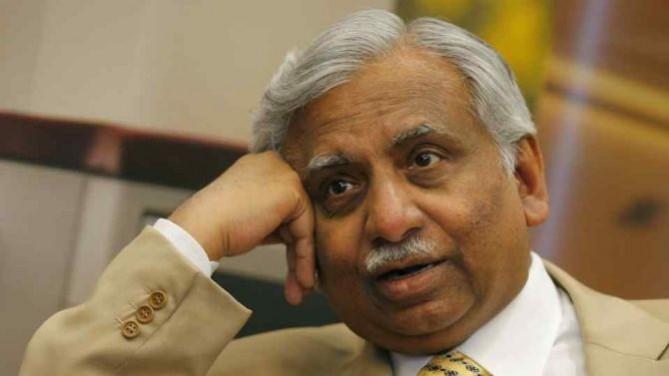

In the latest twist, Naresh Goyal, the founder of Jet Airways, has now offered to inject Rs 250 crore into the beleaguered airline which has been grounded due to the dearth of funds. In a communication to Jet Airways' employees, Goyal said that the funds are now available to banks controlling the airline. Financial daily, Mint reported that Goyal who was forced to step down from the Chairmanship of Jet Airways has offered to invest funds from Jetair Pvt. Ltd where he has the controlling stake.

In the letter to Jet employees he wrote, "Since stepping down from our respective positions, Neeta (Goyal) and I have had no role at Jet Airways after having made every possible sacrifice and commitment to ensure that the best interests of our Jet Airways family are served." Last month Goyal had given his consent to offer the airline Rs. 250 crore as loan collateral. His latest bid to conciliate with the banks comes after the consortium rejected his proposed bid to regain control of the carrier highlighting the non-eligibility conditions.

![The Jet Airways flight coming from Dubai hit a parked catering vehicle [Representational Image] jet airways](https://data1.ibtimes.co.in/en/full/685232/jet-airways.jpg?h=450&l=50&t=40)

Notably, under huge pressure from the existing investors, Goyal was forced to give up his controlling stake in the airline he had started in the early 90s. Jet Airways is reeling under a debt of $1 billion, defaulted on payments several times and died a slow death on April 17 when all of its aircraft were grounded. The grounding of Jet Airways' aircraft resulted in the severe shortage in flight in the domestic market which prompted the government to intervene.

To mitigate the crisis, the Ministry of civil aviation has allotted the slots of Jet at domestic airports to other airlines for a period of three months but the immediate shortage of aircraft is likely to remain. Meanwhile, the consortium of banks has again thrown open the bidding contest to find a possible new investor. The process is likely to get over in the June quarter. Etihad Airways PJSC, India's National Investment and Infrastructure Fund and private equity firms TPG Capital and Indigo Partners has been finalized to place binding bids for the airline.

As per the bidding eligibility conditions, strategic bidder planning to invest into Jet should at least have a minimum net worth of Rs 1,000 crore or at least three years of experience in the aviation sector. Similarly for financial investors, minimum asset under management of must of Rs 2,000 crore or Rs 1,000 crore in committed funds for investment in Indian firms or assets.