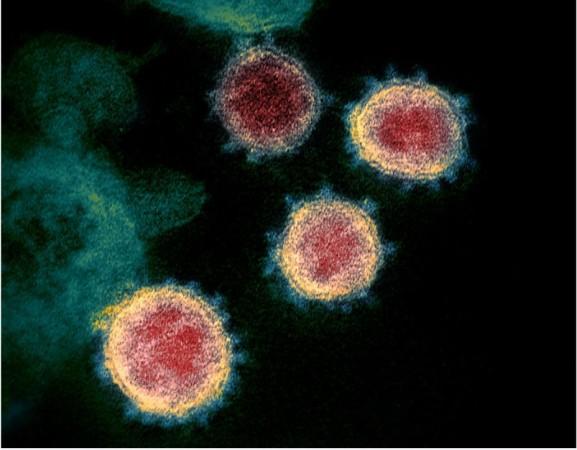

The threat from deadly coronavirus is far from over, as per the numbers given by the Chinese authority more than 72,000 cases have been registered with around 1900 people losing their lives. The numbers are swelling with every passing day throwing a new challenge to World's second-largest economy. China is the manufacturing powerhouse of the world has direct implications on global trade.

For instance, China is the biggest trading partner for India and accounts for almost $70.4 billion of goods exchange between the two countries. The severe shutdown in China has been disrupting multiple sectors in the Indian economy including Pharmaceuticals and the already struggling auto sector. Notably, around 67% of active pharma ingredients come from China. Hyundai and Nissan have in fact temporarily shut down its factories outside China due to the non-availability of parts.

Global trade to take a toll

As per a poll conducted by Reuters, the Chinese economy is expected to grow at 4.5% in the first quarter of 2020 down from 6% in the previous quarter. If the prediction turned out to be true, this will be the lowest pace at which the world's second-largest economy will grow since the global recession in 2008. Apple's Chinese manufacturing partner, Foxconn is facing a severe shortage of components due to which the delivery of the iPhone is expected to be hampered. The company has already issued a statement regarding this development.

Further, the demand for crude oil has also tanked to a considerable level which has resulted in the crash in the oil prices. Moreover, the slowdown in construction activity and consumption may keep the demand for base metal like aluminium, steel, and copper tepid at least in the near term.

A report by CARE ratings highlighted, "Lower absorption by China will keep global inventories of metal products high, which is likely to weigh down on prices of steel, aluminium and copper," states the CARE Rating report." Corona's effect on Travel and tourism has already begun to show its ill impact. As per an estimate by the UN's International Civil Aviation Organization is expecting a loss of $ 4-5 billion in revenues for the first quarter of 2020.