Following the Yes Bank debacle, PhonePe services took a massive hit with all of its digital services reported down. Since PhonePe relies on the Yes Bank to settle its transactions and RBI's moratorium brought the wallet's services to a halt. But after 24 hours of downtime, PhonePe restored its UPI payment services and digital wallet for millions of users.

During the downtime, PhonePe was even offered "help" by rival Paytm, but the former's reply was savage at the least. After its comment, "Form is temporary, class is permanent," PhonePe won the argument. And hours later, it managed to revive full operations.

"Over 15 million customers have used the PhonePe app since we resumed services last night. (This is data till 4 p.m. today) We are also letting our customers know this: Will your @ybl handle still work? Yes, there is absolutely no change in the way you use PhonePe. You don't need to do anything - we have taken care of everything at our end. You can continue using PhonePe as you have in the past," PhonePe spokesperson exclusively told International Business Times, India.

Joining hands with new partner

After Yes Bank, PhonePe now has a new UPI partner, ICICI Bank - one of India's largest banks by turnover. For a brief period, PhonePe had reverted to its old @ybl handle, which now redirects to ICICI.

"We have added ICICI as a new banking partner - your @ybl handle now points to ICICI to ensure a safe, secure and seamless experience," PhonePe spokesperson confirmed to us.

Announcing the new partnership, PhonePe CEO and founder, Sameer Nigam, expressed gratitude towards the new UPI partner.

"We are back with a bang! Would've been impossible to do so in record time without incredible effort & inspirational leadership displayed by @NPCI_NPCI and our new UPI partner @ICICIBank! Will never forget because - A friend in need is a friend indeed," Nigam tweeted.

Setting past differences aside

PhonePe and ICICI Bank's budding love is gratifying for 20 crore users, who had been worried about their favourite mobile wallet's future. But PhonePe and ICICI Bank had a minor scuffle a few years ago, but it's all in the past now.

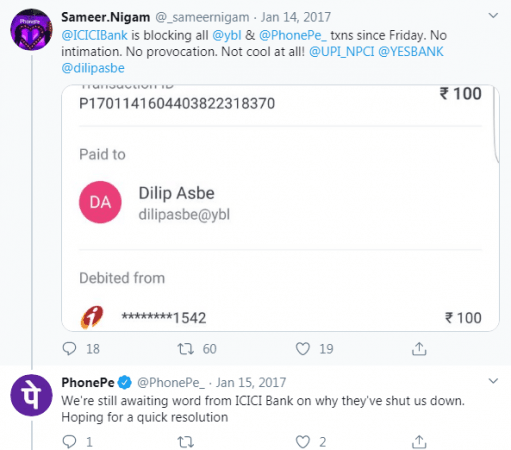

Back in 2017, ICICI Bank had shut PhonePe down for several days and users were unable to transfer money from ICICI Bank using Pockets app to PhonePe wallet. At the time, ICICI Bank cited security concerns over mobile wallets. As years passed, mobile wallets have come to terms and serve as a primary financing solution in today's digital world.

When ICICI Bank blocked PhonePe, Nigam was quick to lash out on the bank by saying: "No intimation. No provocation. Not cool at all!

Luckily, it is all in the past and hope the new partnership between PhonePe and ICICI Bank results in seamless, uninterrupted services for 20 crore users of the mobile wallet across India.