Deutsche Bank will pay $425 million fine to settle charges that it allowed traders to engage in a money laundering scheme using "mirror trades" that improperly shifted $10 billion out of Russia.

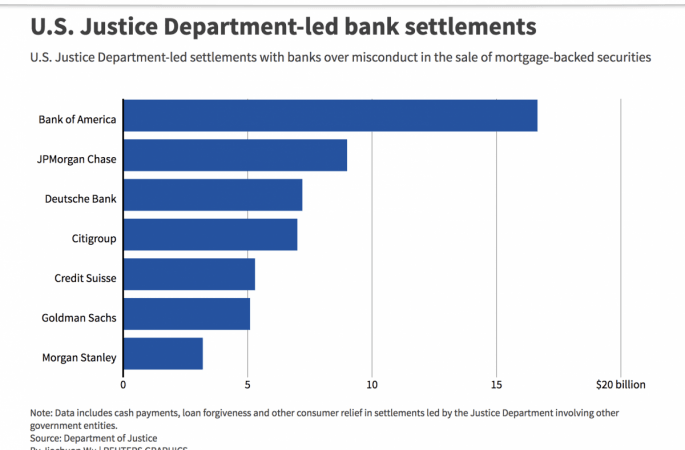

Deutsche Bank, Credit Suisse settle multi-billion dollar lawsuits over US mortgage probe

After violations of New York anti-money laundering laws involving a "mirror trading" scheme among the bank's Moscow, London and New York offices, Deutsche Bank will now be forced to hire an independent monitor for compliance-related issues.

Mirror trading entails the concept of copying somebody else's trades and strategies and profiting from that. Once a strategy by a pro is linked with a client's account, all the signals sent by the strategy will be automatically applied to the client's brokerage account. No intervention is required by the client as all the account activity is controlled by the platform.

The New York Department of Financial Services (DFS) said its investigation found that the bank missed numerous opportunities to detect, investigate and stop the scheme due to extensive compliance failures, allowing the scheme to continue for years.

Separately, the US Department of Justice is also investigating the matter.

Financial services superintendent Maria Vullo said: "In today's interconnected financial network, global financial institutions must be ever vigilant in the war against money laundering and other activities that can contribute to cyber crime and international terrorism."

The DFS found that operating through the equities desk at the Moscow branch, certain clients of the bank purchased Russian blue chip stocks, always paying in rubles. Shortly thereafter, a related counterparty would sell the identical Russian blue chip stock in the same quantity and at the same price through Deutsche Bank's London branch.

The selling counterparty was typically registered in an offshore territory and would be paid for its shares in US dollars. At least 12 entities were involved, and none of the trades demonstrated any legitimate economic rationale.

The New York regulator said this Russian mirror-trading scheme occurred while the bank was on clear notice of serious and widespread compliance issues dating back a decade.

"The offsetting trades here lacked economic purpose and could have been used to facilitate money laundering or enable other illicit conduct, and today's action sends a clear message that DFS will not tolerate such conduct," it said.