After a stellar debut on the NSE, shares of BSE closed at Rs 1,070. In all, 1.58 crore shares changed hands in just one day's trading, indicating phenomenal investor interest for the scrip whose IPO was oversubscribed 51 times. The BSE Sensex closed 14 points up at 28,240 while the NSE Nifty ended 7 points higher at 8,741.

"BSE's whooping listing gains excited markets, which were seen looking for further fuel to add on to the post budget rally, especially with assembly elections starting tomorrow. US Jobs data due for release later in the evening also cast a cloud, with the possibility of having a bearing on rate cut expectations when RBI meets next week," Anand James, Chief Market Strategist, Geojit BNP Paribas Financial Services, said in a note.

BSE Ltd. shares on Friday listed on rival National Stock Exchange at Rs 1,085, 35 percent premium to the issue price of Rs 806. At 10:07 am, BSE shares were trading 7 percent higher at Rs 1,159 from their opening price. The stock touched an intraday high of Rs 1,200. The interest for the scrip could be gauged from the fact that about 1.20 crore (12 million) shares were traded in about 3 hours on the NSE.

Read: World's listed stock exchanges [PHOTOS]

BSE Ltd., Asia's oldest stock exchange, created history on February 3 when its shares got listed after a successful initial public offering (IPO) last month that saw investors lapping up 1.54 crore (15.4 million) shares in a big way. The Rs 1,243-crore public issue was oversubscribed 51 times and the equity shares of Rs 2 face value were offered at a price band of Rs 805-806 per share.

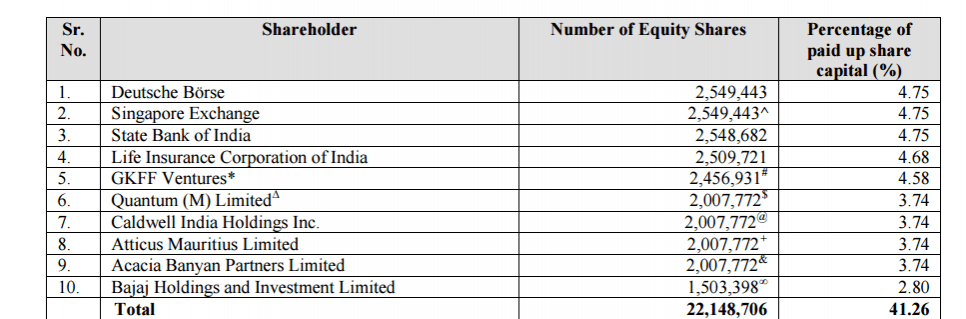

Read: Top 10 existing shareholders of BSE include Singapore Exchange, Deutsche Borse, SBI, LIC

The IPO was open for subscription between January 23 and 25, 2017.

The BSE IPO was in the nature of offer for sale, or OFS, that enables existing shareholders to sell their holdings and encash their profit.

Angel Broking and IDBI Capital Markets & Securities had recommended "subscribe" for the BSE IPO.

Multi Commodity Exchange of India Ltd (MCX) was the first Indian exchange to get listed, in March 2012. The shares opened at Rs 1,387 apiece, a premium of 34.3 percent to the issue price of Rs 1,032. The issue comprising offer of 6.4 million shares was oversubscribed 54 times. On Thursday (February 2, 2017), the MCX stock closed at Rs 1,198 on the BSE, up 1.96 percent from its previous close.

Highlights of the BSE IPO (sourced from the offer documents filed by the exchange):

- The objects of the offer are to achieve the benefits of listing the equity shares on the NSE and for the sale of equity shares by the selling shareholders. Further, the exchange expects that listing of the equity shares will enhance its visibility and brand image and provide liquidity to its existing Shareholders.

- The exchange will not receive any proceeds of the offer and all the proceeds of the offer will go to the selling shareholders in the proportion of the equity shares offered by them.

- The exchange earned net profit of Rs 86 crore for the six-month period ended September 30, 2016 on total income of Rs 273 crore.

- In 2015-16, the BSE's net profit stood at Rs 132 crore on total income of Rs 516 crore.

- The top 10 existing shareholders of the BSE as of December 30, 2016 are:

Some of the top listed exchanges of the world include Intercontinental Exchange (NYSE); Nasdaq, London Stock Exchange Group (LSE); Stock Exchange of Hong Kong and Deutsche Borse.

On January 31, 2017, Intercontinental Exchange had a market capitalisation of $34.5 billion, Nasdaq $11.19 billion, London Stock Exchange Group £10.88 billion, Stock Exchange of Hong Kong HKD 231 billion and Deutsche Borse €16.26 billion.