Forex

Rupee makes a turnaround amid optimism over PM Modi's re-election, becomes Asia's best-performing currency

Rupee rises 35 paise to 71.11 against US dollar

Ominous predictions for rupee: 80 against dollar by year's end and a plunge to 100 later

With Indian rupee plumbing depths, 25 million expatriates to script new remittance record

U.K. Budget 2017: Winners and losers

Japans Prime Minister Shinzo Abe clinches landslide victory in snap election

Conservatives lose overall majority as UK election results in hung parliament

UK election: How did we get here?

David Davis says UK will not be paying £100bn Brexit divorce bill

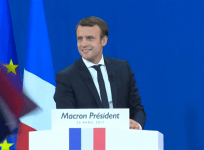

Macron thanks opponents who are calling to vote for him in the second run

Falling pound tempts tourists to shop for luxury brands until they drop

India's foreign exchange reserves touch a historic high of $355.94 billion

Below 69, rupee may depreciate to 73 against US dollar: Sharekhan

Rupee tumbles to two-and-a-half-year low

Advertisement

Advertisement