With International Women's Day (March 8) around the corner, let's take a closer look at the various provisions and schemes initiated by the Ministry of Finance to promote women empowerment in India in the last six years. These schemes have benefited women to help them lead a better life and foster their entrepreneurial dreams.

Stand-Up India Scheme

The Stand-Up India Scheme launched on April 5, 2016, to promote women entrepreneurship at grass root level, seeks to leverage the institutional credit structure and reaches out to the underserved sections of society such as scheduled caste and scheduled tribe, women entrepreneurs to enable them with skills to promote economic growth.

The objective of this scheme is to facilitate bank loans between Rs.10 lakh and Rs.1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower, and at least one woman borrower per bank branch of SCBs for setting up a Greenfield enterprise in the manufacturing, services or the trading sector.

As of February 17, 2020, more than 81 per cent account holders under Stand-Up India Scheme are women. 73,155 accounts have been opened and Rs. 16712.72 crore has been sanctioned and Rs. 9106.13 crore disbursed for women account holders. The government does not allocate funds for loans under the Stand-Up India Scheme, they are extended by lending institutions as per the commercial parameters.

As per data available on February 25, 2020, Rs 18665.75 crore loans were sanctioned by public sector banks and Rs 980.8 crore loans sanctioned by private sector banks, Rs 404.84 crore sanctioned by Regional Rural Banks (RRBs) under the Stand-Up India scheme.

Uttar Pradesh sanctions the maximum loan amounting to Rs 2277.59 crore, closely followed by states of Tamil Nadu, Gujarat and Maharashtra at Rs 1916.87 crore, Rs 1804.49 crore and Rs 1545.66 crore respectively. States of Andhra Pradesh, Telangana and Karnataka sanction Rs 1272.59 crore, Rs 1363.66 crore and Rs 1147.89 crore respectively as of the performance data analysed on February 25, 2020.

Pradhan Mantri MUDRA Yojana (PMMY)

PMMY was launched on April 8, 2015, for providing loans up to 10 lakh to the non-corporate, non-farm small/micro-enterprises. Classified as MUDRA loans under PMMY scheme, these loans are provided by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs.

Under the aegis of PMMY, MUDRA has created three products namely 'Shishu', 'Kishore' and 'Tarun' to signify the stage of growth/development and funding needs of the beneficiary micro unit/entrepreneur, while providing a reference point for the next phase of growth.

The MUDRA scheme envisions "To be an integrated financial and support services provider par excellence benchmarked with global best practices and standards for the bottom of the pyramid universe for their comprehensive economic and social development"

As of January 31, 2020, more than 22.53 crore loans have been sanctioned under the PMMY MUDRA scheme, of which more than 15.75 crore loans have been extended to women. This means 70 per cent of the total loan borrowers are women.

Pradhan Mantri Jan-Dhan Yojana (PMJDY)

Launched on August 28, 2014, the PMJDY scheme was extended and revised with effect from August 14, 2018, provides universal access to banking facilities with at least one basic banking account for every adult, financial literacy, access to credit, insurance and pension.

As of February 19, 2020, of the 38.13 crore total beneficiaries of the PMJDY scheme, 20.33 crore beneficiaries are women which amounts to 53 per cent.

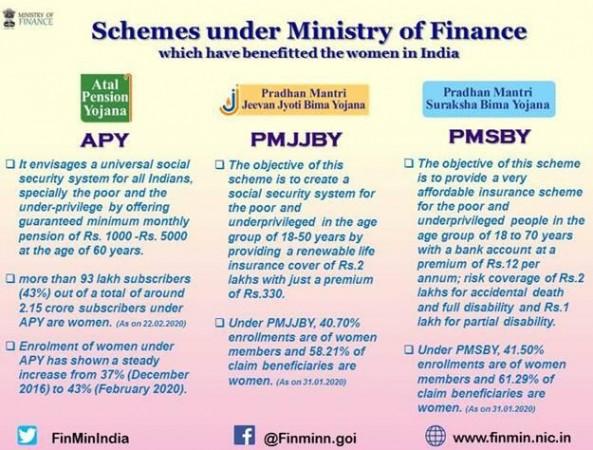

Atal Pension Yojana (APY)

APY was launched on May 9, 2015, to provide a universal social security system for all Indians, especially the poor and the underprivileged by offering a guaranteed minimum monthly pension of Rs. 1000 to Rs. 5000 at the age of 60 years.

This scheme is open for subscription through banks and post offices on an on-going basis. Of the total around 2.15 crore subscribers under APY, more than 93 lakh subscribers (43 per cent) are women as of February 22, 2020.

With old age income security being increasingly prioritised by women, their enrolment under the APY has shown a steady increase from 37 per cent in December 2016 to 43 per cent in February 2020. Despite low labour force participation rates and the high gender wage gap, women are at the forefront of savings for old age income security. Participation of women are higher than men in the States /UTs of Sikkim (73%), Tamil Nadu (56%), Kerala (56%), Andhra Pradesh (55%), Puducherry (54%), Meghalaya (54%), Jharkhand (54%), and Bihar (52%).

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

PMJJBY was launched on May 9, 2015 with an objective to create a social security system for the poor and the underprivileged in the age group of 18 to 50 years by providing a renewable life insurance cover of Rs 2 lakhs with just a premium of Rs 330.

Under PMJJBY, 40.70 per cent enrollments are of women members and 58.21 per cent of claim beneficiaries are women as of January 31, 2020.

Of the total 4,71,71,568 enrollments under PMJJBY, 1,91,96,805 are women. As of January 31, 2020, 95,508 claims have been paid to female beneficiaries out of a total of 1,69,216 claims paid.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

The PMSBY scheme launched on May 9, 2015, is intended to provide an affordable insurance scheme for the poor and underprivileged people in the age group of 18 to 70 years with a bank account at a premium of Rs.12 per annum; risk coverage of Rs.2 lakhs for accidental death and full disability, and Rs.1 lakh for partial disability.

Under PMSBY, 41.50 per cent enrollments are of women members and 61.29 per cent of claim beneficiaries are women as of January 31, 2020. Of the total of 15,12,54,678 enrollments, 6,27,76,282 are women, and 23,894 claims have been paid to women beneficiaries out of a total of 38,988 claims paid as of January 31, 2020.