The third quarter (October-December) has begun on a positive note for consumption companies, as could be seen from the volume sales of automobile makers and the October data for Nikkei India Manufacturing PMI, which hit a 22-month high of 54.4. Coupled with a good monsoon and its impact on rural demand in the coming months, these companies are expected to post good numbers in the coming quarters.

The performance is set to reflect in the share prices of these companies, according to brokerage Angel Broking, in the wake of Q2 results, especially by automobile firms.

"The management commentary of following the results indicated that some green shoots of recovery are seen in the rural market and more growth will be visible in the next few quarters," it said in a note.

"We also observe improving sales and operating margins of some companies from food processing, pesticide, paint, and plastic industries. As the consumer demand strengthens, corporate earnings are also expected to pick-up," the Monday note added.

Bonds no longer attractive

In the context of falling inflation rate, interest rates are bound to fall further, making bonds unattractive as the Reserve Bank of India could effect yet another rate cut when the MPC meets next month, making stocks a better investment proposition.

"Due to low yields, equity has emerged as an attractive asset class and this can clearly be seen from the negative FII inflows in the debt this year so far. In the earlier instances when FII inflows in debt were negative, equity generated strong returns in the subsequent year.

"The falling bond yields and improving macros are possibly indicating that we will see a strong equity market next year and inflows will also remain strong," Angel Broking said.

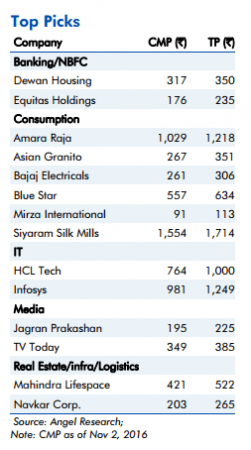

Top picks of Angel Broking

In the light of the positive factors listed above, the brokerage has picked up stocks that are expected to deliver good returns over a period of time. These include interest sensitive sectors like Dewan Housing, Mahindra Lifespace, and consumption plays like Bajaj Electrical, Amara Raja, Blue Star, Asian Granito and Mirza International.

Dewan Housing

The brokerage expects Dewan Housing's assets under management to grow at a CAGR of 21 percent over FY2016-18, as demand for housing in the middle- and low-income groups pick up, while PAT CAGR expected to be 23 percent.

Equitas Holdings

After conversion to a small finance bank, the company has started raising deposits at a lower cost vs borrowings, leading to a better cost of funds. Hence, the company's NIM is likely to remain strong at ~10-11 percent going ahead. The brokerage expects the company to post a strong loan book and earnings CAGR of 38 percent & 37 percent over FY2016-18E. The stock currently trades at 2.3x FY2018E BV.

Amara Raja Batteries (ARBL)

With the automotive OEMs following a policy of having multiple vendors and with ARBL's products enjoying a strong brand recall in the replacement segment, the company is well poised to gain further market share. Given the economic recovery and market share gains, the company is expected to grow at a CAGR of 18 percent over the next two years as against industry growth of 10-12 percent.

Bajaj Electricals

With expectation of timely execution of new projects in the E&P segment and with the Lighting and Consumer Durables segments expected to benefit from an improvement in consumer sentiments going forward, the brokerage expects the company's top-line to grow at a CAGR of ~12 percent to Rs 5,805 crore and bottom-line to grow at a CAGR of 24 percent to Rs 147 crore over FY2016-FY2018E.

Blue Star Limited (BSL)

BSL is one of the largest air-conditioning companies in India. With a mere 3 percent penetration level of ACs vs 25 percent in China, the overall outlook for room air conditioner (RAC) market in India is favourable.

Mirza International

In the branded domestic segment, the Mumbai-based brokerage expects the company to report a ~24 percent CAGR over FY2016-18E to Rs 346 crore. It anticipates strong growth for the company on the back of (a) wide distribution reach through its 1,000+ outlets including 120 exclusive brand outlets (EBOs) in 35+ cities and the same are expected to reach 200 over the next 2-3 years and (b) strong branding (Red Tape) in the shoe segment.

Siyaram Silk Mills Ltd. (SSML)

SSML has strong brands which cater to premium as well as popular mass segments of the market. Further, SSML entered the ladies' salwar kameez and ethnic wear segment. Going forward, Angel Broking believes that SSML would be able to leverage its brand equity and continue to post strong performance.

The brokerage expects SSML to report a net sales CAGR of ~12 to ~ Rs 2,040 crore and adjusted net profit CAGR of ~14 percent to Rs 115 crore over FY2016-18E on back of market leadership in blended fabrics, strong brand building, wide distribution channel, strong presence in tier II and tier III cities and emphasis on latest designs and affordable pricing points. At the current market price, SSML trades at an inexpensive valuation.