2017 had been phenomenal year for the Indian market as benchmark Nifty 50 climbed around 2500 points or 31.2 percent since the start of 2017, which is the highest in three years.

Shares of 33 of the 50 Nifty companies beat analyst forecasts made at the start of the year, the highest since 2014. However, five stocks rose in line with estimates, while 12 missed the mark.

The year started with the shocker of last year November's demonetisation and many analysts expected market to report muted growth. However, bottoming out demonetisation impact happened faster than expected.

"Several companies were able to shrug off the note ban earlier than expected and ended up beating estimates," Sunil Kewalramani, chief investment officer at Global Money Investor, told BloombergQuint.

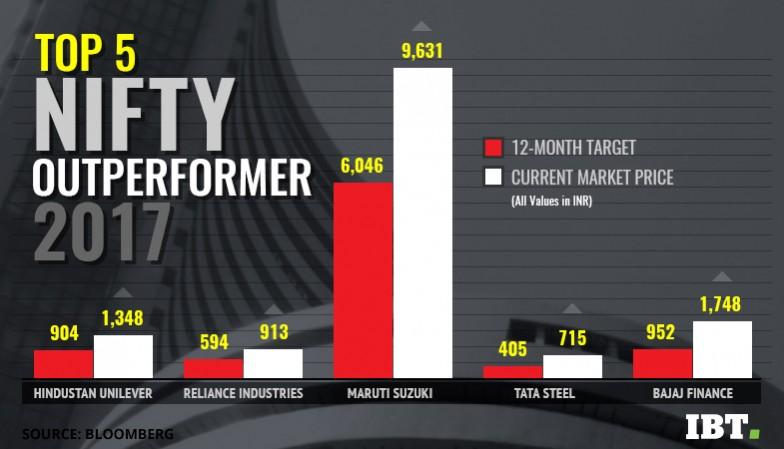

Below are the top five Nifty outperformers:

Bajaj Finance

Bajaj Finance beat the market analysts' forecast by the highest margin. The non-banking financial company (NBFC) added to the index in September, rose 83.7 percent more than consensus target price.

Market participants set 12-months price target at Rs 952 but at the end of the year, the firm's shares are hovering around Rs 1,748. NBFC major net profit rose 37 percent during the September quarter to Rs 557 crore as against Rs 408 crore during the same period last year.

Tata Steel

India's largest steelmaker's shares have given a return of 81 percent since the start of the year. The company has beaten market analysts' consensus estimates, rose 76.3 percent more than consensus target price.

Analysts set 12-months price target at Rs 405 but at the end of the year the firm's shares are hovering around Rs 715.

However, in terms of company's financial, the steelmaker disappointed the market by reporting a consolidated net profit of Rs 1,017.8 crore in quarter ended September, as compared with the Rs 1,663 crore profit estimate by analysts.

Maruti Suzuki

The shares of India's biggest passenger vehicle (PV) company—Maruti Suzuki touched Rs 10,000 mark earlier this week for the first time. The carmaker's shares went up by around 84 percent in 2017 alone, as against the benchmark BSE Sensex rose 28 percent.

The country's top-selling car maker beats the market analysts forecast, rose 59.3 percent above than consensus target price.

Maruti Suzuki posted more than a 3 percent rise in its quarterly profit, beating analysts' estimates for the September ended quarter with profit climbing to Rs 2,484 crore, versus Rs 2,402 crore in the corresponding quarter same year.

Reliance Industries

India's richest man—Mukesh Ambani's Reliance Industries (RIL) has been in news this year with the launch of Reliance Jio Infocomm, which disrupted the telecom industry and triggered price war among the players. The company's stock is one of Nifty outperformers of year 2017.

The country's biggest company in terms of market capitalisation, beat the market analysts estimate and rose 53.8 percent above the consensus target price. Market participants set 12-months price target at Rs 594 but at the end of the year, the firm's shares are hovering around Rs 913.

RIL reported a 7.3 percent increase in standalone net profit to Rs 8,265 crore for the July- September period. The profit earned in this quarter is the highest ever for the conglomerate.

Hindustan Unilever

At the fifth spot is the consumer goods making giant Hindustan Unilever which beat analysts' estimate by 49.2 percent more than consensus target price.

The FMCG firm has reported profit higher-than-expected at Rs 1,276 crore in the September quarter of the ongoing fiscal, growing 16.4 percent compared with Rs 1,096 crore in same quarter last fiscal.

The company's stock has went up by around 63.5 percent in 2017 alone, as against the benchmark BSE Sensex rose 28 percent.