Planning money matters becomes easier when you break it into simple steps. Many people use a Systematic Investment Plan to build wealth and a Systematic Withdrawal Plan to receive steady payouts. Both tools serve different roles. Using a SIP calculator and SWP calculator helps you plan each stage with clarity and confidence.

Understanding SIP and How It Works

A SIP is a simple method of investing at regular intervals. You choose an amount and invest it monthly. This makes it easy to begin and maintain. You buy more units when prices are low and fewer units when prices are high. Over time, this helps balance the cost of your investment.

A SIP calculator helps you estimate how your money may grow. You can adjust the amount and duration to see how the future value changes. This lets you plan long term goals with a clear view. It is useful for goals like education, a home, or general wealth creation. The steady flow of money into your investment builds discipline and keeps your plan stable.

Understanding SWP and Why People Use It

An SWP lets you withdraw a fixed amount at regular intervals. It is helpful when you want steady cash flow while keeping your remaining money invested. Many people use it during retirement or when they need predictable payouts for monthly expenses.

A SWP calculator shows how long your investment may last. It also helps you test different withdrawal amounts so you can make safe decisions. This ensures that you do not withdraw too much too soon. It is a practical way to manage money once your goals reach the stage where you need regular income.

Key Differences Between SIP and SWP

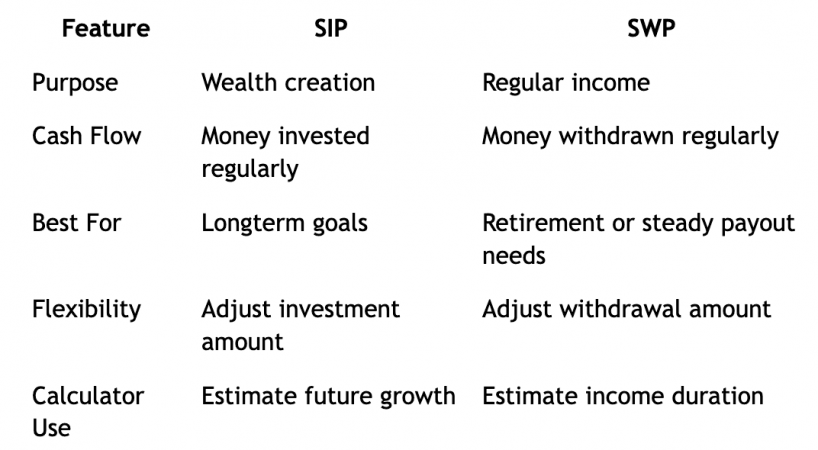

SIP and SWP are opposite processes. One helps you invest steadily and the other helps you withdraw steadily. SIP is about wealth creation. SWP is about wealth use. Yet both can support each other.

SIPs work well during the earning phase. SWPs work well when you want controlled withdrawals. It is common to use SIPs for many years and then switch to SWPs later. This keeps your money active across different stages of life.

This table shows the simple difference between the two approaches. It also helps you decide which one suits your current needs.

How SIPs Support Long Term Goals

SIPs help you start small and grow gradually. You can increase the amount whenever your income rises. This slow and steady approach suits many young investors. It also suits people who want to build a financial habit without thinking about market timing.

A SIP calculator supports this early planning. It lets you check how much you need to invest to reach a specific goal. You can explore various scenarios and choose the one that fits your comfort zone.

How SWPs Help You Manage Regular Income

SWPs allow planned withdrawals without stopping your investment. This creates a smooth flow of income. It also keeps your remaining money invested so it can continue to grow. This makes SWPs useful for people who want stability after reaching their goals.

A SWP calculator helps you check how long the balance may last based on your chosen withdrawal amount. It shows the impact of changing the payout, helping you avoid any pressure on your savings.

Choosing Between SIP and SWP

Your choice depends on where you are in your financial journey. If you are building wealth, SIP is the better option. If you are managing wealth and need regular payouts, SWP is the right tool.

Think about your time frame, comfort with risk and your cash flow needs. Many people use both at different times. They invest through SIPs during earning years and then shift to SWPs later. This develops a strong structure for both growth and income.

Using Calculators to Strengthen Your Planning

A SIP calculator and SWP calculator allow you to test your ideas before taking action. They provide a clear picture of what may happen based on your inputs. These calculators help you stay realistic and reduce confusion.

Good planning is not about guessing markets. It is about staying consistent with your goals. SIPs help you grow. SWPs help you use that growth wisely. When combined, they create a smooth and balanced financial path.

Conclusion

Choosing between SIP and SWP becomes simple when you understand your goals. SIP supports your growth. SWP supports your income needs. Using calculators strengthens every stage of your journey. They help you take decisions that match your life plans and keep your money working for you. With clear planning, you stay in control and move towards your goals with confidence.