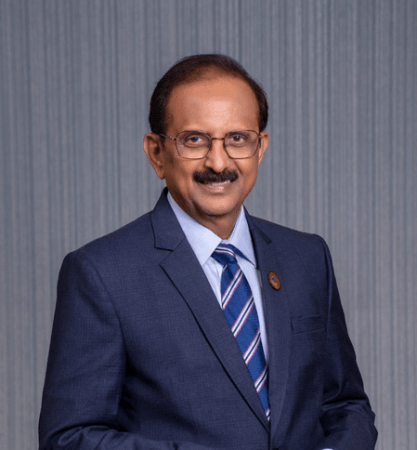

State Bank of India (SBI) Chairman CS Setty said on Wednesday that the bank is working on simplifying the Know Your Customer (KYC) and re-KYC processes to make them more user-friendly.

Speaking to reporters on the sidelines of Global Fintech Fest 2025, he added that SBI will work closely with regulators and the government to bring these changes.

"We are working on the simplification of KYC processes. Even if it means engaging with regulators and the government, we are taking the initiative from SBI's side to make the entire KYC process easier," Setty told reports.

"I think banks like SBI are well-versed in acquisition and financing," he added.

He said the shift to an expected credit loss (ECL) based system of asset provisioning will not impact the balance sheets of banks, given the extended transition period given by the central bank.

"Technologically we are ready in terms of models and all, maybe some adjustments are required based on the final guidelines which have been ensured, but more importantly the long transition time which is given, we believe that there will be limited impact on the balance sheets of the banks," he added.

Setty highlighted the need for a simpler KYC system, especially as more people are joining the formal banking network.

He said all stakeholders -- including policymakers, fintech companies, and technology developers -- must work together to streamline KYC procedures for better inclusion.

Earlier this year, on June 12, the Reserve Bank of India (RBI) revised its KYC rules to make the process more flexible.

The new guidelines allow Business Correspondents (BCs) to help customers with KYC updates and require banks to send advance reminders for KYC deadlines.

The RBI had also noted a large backlog in KYC updates for accounts linked to government schemes such as Direct Benefit Transfers (DBT), Electronic Benefit Transfers (EBT), and the Pradhan Mantri Jan-Dhan Yojana (PMJDY).

Speaking about lending on digital platforms, Setty said that SBI needs to strengthen its loan collection mechanism before introducing more credit products on the Unified Payments Interface (UPI).

"We need to get the collection piece right before launching more products on UPI. It's a very powerful tool and a key element of inclusive credit for people," he said.

(With inputs from IANS)