Samsung's announcement of its planned investment of Rs 4,915 crore in India on Wednesday left the country's Information and Technology Minister, Ravi Shankar Prasad, overwhelmed with gratitude, saying the South Korean conglomerate would help India become a $1 trillion digital economy by 2020.

Irrespective of whether Samsung will actually help India achieve the said milestone or not, what teh company is almost certain about is to exploit the potential of a rapidly growing market where even its U.S. rival Apple has started assembling iPhones.

"The investment will be used to add fresh capacity at Samsung's Noida plant, where the company manufactures smartphones, refrigerators and flat panel televisions," Samsung said in a statement, adding that the "investment reconfirms its commitment to the "Make in India" initiative launched by the Indian Prime Minister Narendra Modi in 2014.

Samsung also said that it would spend the money over three years to expand the plant on an additional 35 acres of land, which will help the company double the production capacity of both mobile phones and refrigerators. While the company currently produces 10 percent of its overall products in India, it aims to increase the share to 50 percent by 2020.

"A bigger manufacturing plant will help us cater to the growing demand for Samsung products across the country," H.C. Hong, president and CEO of Samsung Southwest Asia, reportedly said. "We wish to make India a global production hub with support from the government," he added.

According to Hong, every product, including the recently launched Galaxy S8 and S8+ handsets, being sold in the country are "Made in India."

It's not a sudden change of heart

The Noida plant started with the manufacturing of televisions in 1997 while the current mobile phone manufacturing unit was added to the facility in 2005.

There could be multiple reasons why Samsung took more than a decade to announce the expansion of the plant. But the fact that the mega investment came after Apple's recent announcement of the beginning of initial production of the iPhone SE at its Bengaluru facility suggests that Samsung cannot afford to ignore a growing market like India, which is likely to become promising manufacturing hub.

Although Apple was somewhat forced to set up a domestic manufacturing plant in India to eventually launch its own retail stores in the country, there are obviously some cost saving benefits that Apple can take advantage of. Domestic production of the iPhone SE would make it possible for Apple to sell the handset at a lower price, helping it better to take on Chinese smartphone makers like Huawei, Oppo and Vivo that are currently dominating the Indian market.

Strengthening foothold

While this tactic is not something new to Samsung, the recent growth of Chinese players on the with their aggressively low pricing strategies might have made the Galaxy-maker realise that it needs to reinforce its foothold in India.

"Samsung would want to reduce their dependence on manufacturing in Vietnam and shift more operations to India," Tarun Pathak, associate director at technology research firm Counterpoint, told Reuters. "India looks like a promising manufacturing hub in the coming years and Samsung could make it their base for exports."

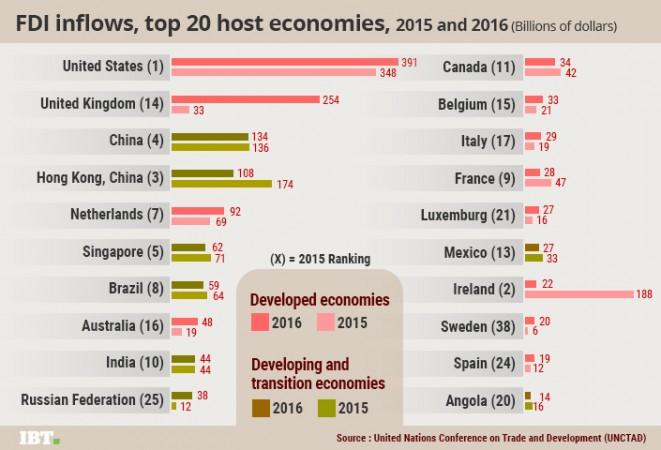

In addition, India is also expected to remain among the top three investment destinations, after the United States and China, till 2019.

According to the World Investment Report 2017 by the United Nations Conference on Trade and Development (UNCTAD), India ranked ninth in terms of FDI inflows in 2016, with total investment worth $44 billion.