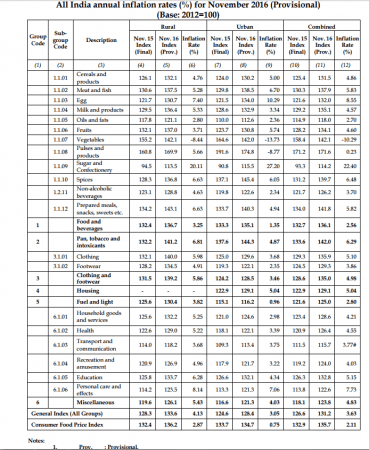

Demonetisation dragged retail inflation to a two-year low of 3.63 percent in November, aided by a sharp fall in prices of food items to 2.11 percent. The expected fall lifted stock market indices on Tuesday; the BSE Sensex closed 183 points higher at 26,698 and the NSE Nifty was up at 8,222.

Retail inflation stood at 4.20 percent in October, after food inflation dropped to 3.32 percent.

Vegetable prices actually declined by 10.29 percent in November in compared to the corresponding month last year since the cash-dominated trade was hit hard due to currency crunch as a result of demonetisation.

When compared to October 2016, prices of foods and beverages — that account for almost 55 percent in the inflation index — witnessed a drop, indicating that the consequences of currency ban lowered prices.

November inflation is even below the RBI's target of around five percent.

The fall in inflation was on expected lines and influenced Tuesday's rally on stock markets, apart from other positive factors.

"Market gained on account of positive European market and short covering ahead of FED policy tomorrow. Investors are eyeing today's CPI data to ascertain the extent of demonetizations impact in conjunction with RBI's recent monetary policy stance," Vinod Nair, Head of Research, Geojit BNP Paribas Financial Services, said in a note.

Tata Motors, Adani Ports, Axis Bank and Wipro were top Sensex gainers.

Foreign institutional investors (FIIs/FPIs) were net sellers of Indian equities worth Rs 2,181 crore on Tuesday, according to provisional data published by the stock exchanges.