The Reserve Bank of India (RBI) on Friday retained its key lending rate during the first monetary policy review of FY23. Besides, the growth-oriented accommodative stance was also retained.

Accordingly, the Monetary Policy Committee (MPC) of the central bank maintained the repo rate, or short-term lending rate, for commercial banks, at 4 per cent. It was widely expected that MPC would hold rates and the accommodative stance.

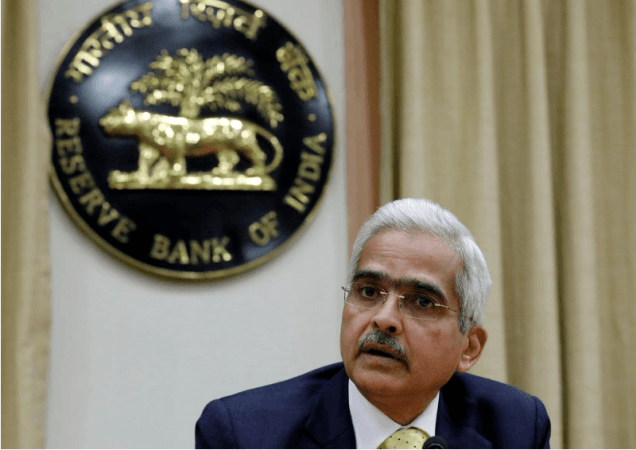

The Monetary Policy Committee (MPC), headed by RBI Governor Shaktikanta Das, is held its first meeting in the current financial year from April 6 to 8 and the outcome will be announced at 10 am today (April 8).

In the last 10 meetings, the MPC has kept interest rate unchanged and also maintained an accommodative monetary policy stance.

The repo rate or the short-term lending rate was last cut on May 22, 2020 and the rate remained unaltered at a historic low of 4 percent since then.