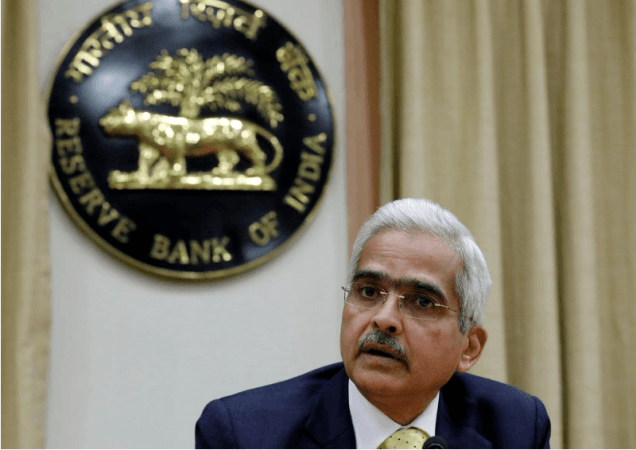

In a surprising move, the Reserve Bank of India (RBI) raise the repo rate by 40 basis points to 4.40%. The move is seen as a measure by the central bank to check the rising inflation in the country. The decision was announced by RBI Governor Shaktikanta Das after the bank's monetary policy committee (MPC) decided unanimously in an off-cycle meeting on Wednesday to raise the repo rate by 40 basis points (bps).

As a result, the standing deposit facility (SDF) rate has been changed to 4.15 per cent, while the marginal standing facility (MSF) rate has been adjusted to 4.65 per cent, and the Bank Rate has been adjusted to 4.65 per cent. The MPC, on the other hand, opted to stay accommodative while working on removing accommodation to ensure that inflation remains within target while supporting growth in the future.

The repo rate is the rate at which commercial banks borrow money from the central bank by selling their assets, in contrast, the reverse repo rate is the rate at which the central bank borrows money. As India's embryonic economic recovery progresses, these rates are critical in encouraging credit and corporate investments. The evaluation of the economy by the Monetary Policy Committee (MPC) is crucial for markets and general business confidence.

Inflationary pressure on the economy

Despite inflationary headwinds sweeping the world and India in the midst of the Russia-Ukraine conflict, the RBI held two benchmark economy-wide interest rates steady at record lows last month, signalling that the RBI continues to prioritise GDP recovery.

The RBI governor added that global oil prices are holding above USD 100 a barrel, which is seeping into local fuel prices, citing inflationary concerns. The RBI Governor stated following the unexpected MPC rate review meeting that geopolitical concerns are boosting inflation.

"Nine out of the 12 food subgroups registered an increase in inflation in March. High-frequency price indicators for April indicate the persistence of food price pressures," Das said.