Baahubali 2 (Baahubali: The Conclusion) grossed Rs. 1,300 crore in 13 days since release (on April 28) worldwide, but the film's box-office success has not reflected in the share prices of two listed multiplexes — PVR and Inox Leisure. The share prices of two companies have actually dropped more than 5 percent, based on their Friday (May 12) and April 28 closing prices.

PVR ended at Rs. 1,524, down 5.51 percent from its April 28 closing of Rs. 1,613, while Inox closed 6.04 percent to Rs. 280 from its closing price of Rs. 298 on the day of the movie's release.

Also read: Baahubali 2: Many key takeaways from movie's success, says Angel Broking

During the period, the BSE Sensex gained almost 1 percent.

On Friday, the BSE Sensex closed 63 points lower at 30,188 while the NSE Nifty ended at 9,405, down 17 points. Top index losers were Asian Paints, Axis Bank and ICICI Bank.

The fall was triggered by two factors — Yes Bank reporting lower non-performing assets (NPAs) and private weather forecaster Skymet predicting weak monsoon, in sharp contrast to the government's India Meteorological Department's normal monsoon prediction that triggered a rally a few days ago.

"NPA worries have resurfaced after a banking major's report differed with RBI's NPA classification, and investors may be seeing this as a warning that there could be more such divergences over bad loan estimates. Skymet's warning of weak monsoon also served to put brakes on recent rallies, as much of the momentum was built on IMD's forecast for normal monsoons," Anand James, Chief Market Strategist, Geojit Financial Services, said in a note.

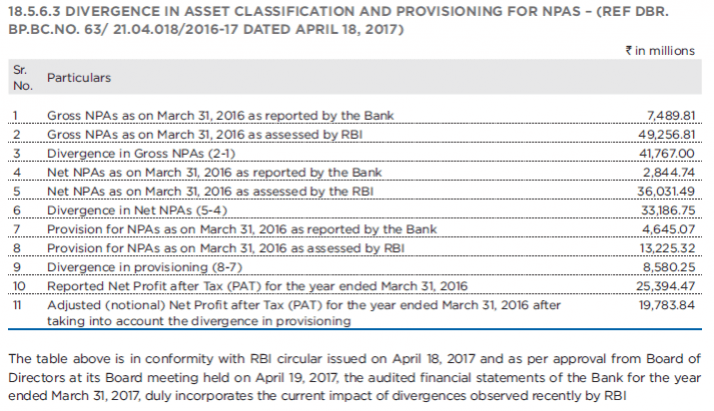

Yes Bank, a private sector lender, under-reported NPAs of almost Rs. 4,100 crore. The bank had reported gross NPAs of Rs.748.98 crore as of March 31, 2016 as against Rs. 4,925 crore assessed by the RBI, resulting in net profit overstated at Rs. 2,539.4 crore instead of Rs. 1,978.3 crore. Yes Bank shares plunged 6.04 percent to close at Rs. 1,484.

Stocks that ended with gains included Hero Motocorp and Infosys.

Despite markets ending with losses, select stocks rallied and hit new 52-week highs on Friday; these included Kotak Mahindra Bank, Piramal Enterprises, Allahabad Bank, LTI (formerly L&T Infotech), Escorts and Titan Company.