Paytm, one of India's major unicorns, is running up massive losses in a tough market. Losses jumped more than 165 percent in the last fiscal with a marginal surge in revenue amid tough competition from Google Pay and PhonePe, the latest numbers show. This happened despite transactions through Paytm rising significantly since the demonetisation.

As per a report in the Economic Times, Paytm's parent One97 Communications reported Rs 3,959.6 crore in net losses for the financial year ending March 31, 2019, in comparison to Rs 1,490 crore for the same period in the previous year. The company's standalone revenue was Rs 3,319 crore, vis-a-vis Rs 3,229 crore in 2017-18. Considering all its subsidiaries including Paytm Money for mutual fund investments, Paytm Financial Services, Paytm Entertainment Services and others, the company reported a net loss of Rs 4,217 crore.

Moreover, Paytm Money also reported a net loss of Rs 36.8 crore in FY19. "For the last two years, we have been investing $1 billion each year to expand the digital payments ecosystem in our country. We will further invest about $3 billion in the next two years to scale the same," a Paytm spokesperson said. He further went on to add: "We believe India is at the inflection point of digital payments and Paytm's sole focus is towards solving the merchant payments and offering them financial services. We will invest Rs 20,000 crore in the next two years towards achieving this."

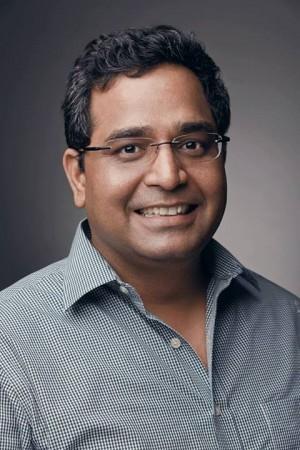

At a time when the company's net losses are mounting Paytm founder Vijay Shekhar Sharma, who also holds the post of managing director of the parent entity and owns 15.7 percent of the company, took a salary of Rs. 3 crore last year along with added benefits.

Despite the company's poor revenue generation in recent times, the company plans to go public within the next two years. Sharma had recently admitted that the roadmap was not ready yet and he wanted Paytm to generate more revenue before going public. In the first three months of the running calendar year, Paytm registered 1.2 billion merchant transactions through 14 million retail stores, the latest numbers released by the company.