![[Representational image] Salary](https://data1.ibtimes.co.in/en/full/634974/salary.jpg?h=450&l=50&t=40)

It was expected that Budget 2018 would offer some salve to the salaried class which has always been the favourite target of finance ministers looking to shore up revenues to keep the bloated government machinery running.

Union Budget 2018 highlights: FM throws cold water on hopes of individual taxpayers

There were high expectations that the budget would propose to increase the personal tax exemption limits and raise the current basic tax slabs. But Budget 2018 disappointed the salaried class with no changes offered in tax slabs.

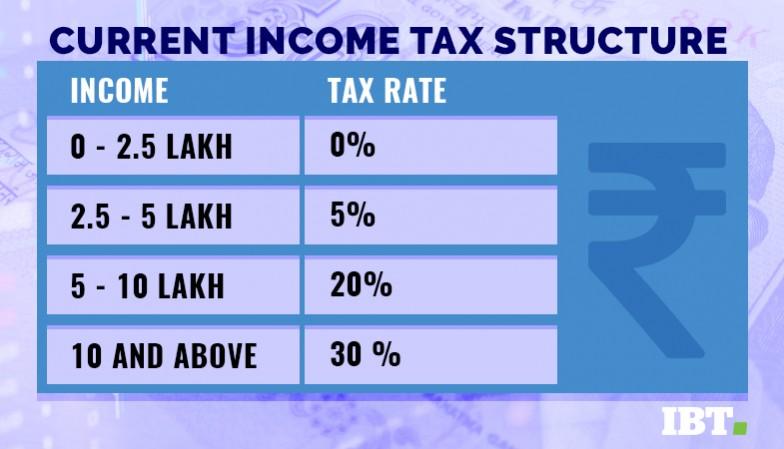

A person whose total income exceeds the tax exemption limit set by the government has to pay income tax. This has to be paid based on prevailing rates. Currently, people earning up to Rs 2.5 lakh per annum are exempted from income tax. There was speculation that the finance minister will increase the current basic income tax slabs to Rs 3 lakh. But he disappointed by going by the current rates.

Here are major announcements related to personal tax from Union Budget 2018:

- The government has made many positive changes in personal income tax rates in the past year so no changes will be there in personal tax rates and tax slabs in Budget 2018.

- For all of the employees, the government would continue to make 12% contribution towards the Employee provident fund account for three years' time.

- Women contribution to EPF reduced to 8% for first 3 years without affecting employer's contribution.

- Seventy lakh formal jobs have been created this year. Government to contribute 12% of EPF contribution for new employees in all sectors.

- In a relief for salaried taxpayers, Arun Jaitley announced standard deduction of Rs 40,000 under the heads of transport and medical reimbursement. The facility is extended to pensioners as well.

- The education cess on personal income tax will be raised to 4 percent from the present 3 percent.

"The salaried class was looking forward to either a realignment of tax slabs or significant benefit in the form of standard deduction. Though the standard deduction of Rs 40,000 looks attractive the benefit is significantly diluted since medical reimbursement of Rs 15,000 and transport allowance of 19,200 have been removed. The increase of cess on the tax to 4% from current levels of 3% also eats into the savings", Saraswathi Kasturirangan Partner of Deloitte, told International Business Times India.