A truncated week, likely to be dominated by US-China trade talks and global markets' response to US GDP numbers, awaits traders who return to the market on Tuesday after an extended weekend. Monday's holiday is for Lok Sabha elections in Maharashtra. The market will remain open on Tuesday but close again on Wednesday for Maharashtra Day holiday.

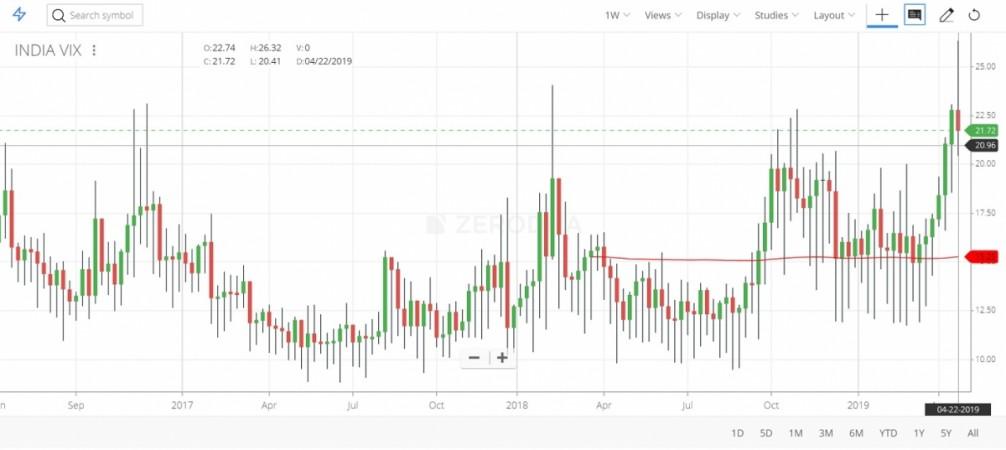

The market is likely to remain range-bound with increased volatility as the India VIX has gained 40 per cent during the month. Nifty's 1 per cent gain during the month despite hitting a record high of 11,856 on April 18 has been marked by extreme choppiness.

However, some experts say the psychological level of 12,000 is achievable despite some major hurdles, according to a MoneyControl report. The 80 per cent rollover of May series contract – higher than three-month average and highest rollover since September 2016 – suggests the bullish sentiment.

The volatility index India VIX closed at 21.45 on April 26, a multi-year high, amid Lok Sabha election uncertainty, rise in crude oil prices, and weakness in the Indian currency. Although the crude worries have eased on Opec promise, the election uncertainty remains as the nation concluded the fourth-phase polling in the seven-phase election on Monday. The market will be conscious of the international crude price movement and US-China trade talks. World's top two economies have been hopeful of a breakthrough as the talks begin on Tuesday in China, according to a Reuters report.

"March series' fabulous rally of 7 per cent was followed by a subdued one. In the April series, the fear index (India VIX) surged 40 per cent but benchmark index traded in a range of merely 300 points," the report quoted Sneha Seth of Angel Broking as saying. "Rollovers in Nifty stood at 81 per cent, highest after September 2016. Wherever we witnessed some profit booking, stronger hands preferred adding fresh longs. In fact, they rolled their bullish bets in index futures, resulting in their 'Long Short Ratio' jumping from 69 per cent to 75 per cent series-on-series."

Bombay Stock Exchange (BSE) Sensex and National Stock Exchange (NSE) Nifty that closed on Friday at 39,049 points and 11,754 respectively are expected to trade sideways when the market opens o Tuesday, the last day of the month. Market observers believe the strong support in the 11,500-11,550 zone will help stop any slide while a move to the upside could take Nifty over 12,000, even in briefly. "Technically, Nifty is moving in a channel of 11,650-11,850 where it is likely to break out on the upside with a potential target of 12,500," the report quoted Amit Gupta of TradingBells as saying.

Asian markets have been mixed on Monday with Hong Kong's Hang Seng gaining nearly 1 per cent and South Korean Kospi 1.7 per cent and Shanghai losing 0.77 per cent. Japan's Nikkei did not see any trading on account of a ten-day annual holiday.