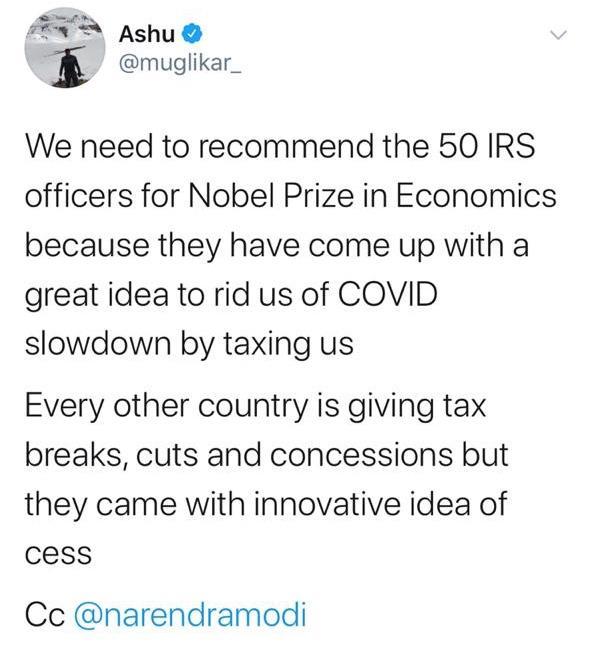

No, that's not exactly what they recommended, but if you pay close attention to social media chatter, you would see people pretty much infer that from the recommendations.

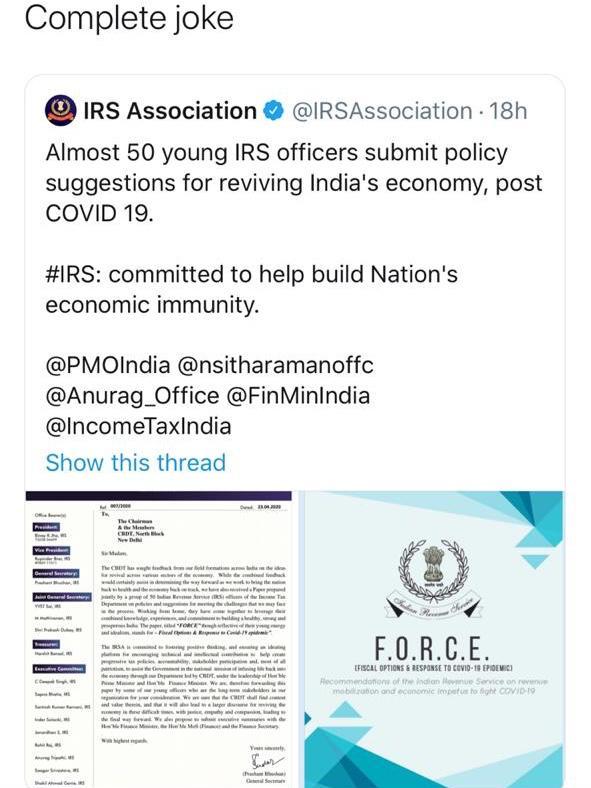

As per around 50 officers of the Indian Revenue System (IRS), India's dwindling economy could be saved by putting in place a set of new provisions such as introducing a one-time COVID-19 cess, collecting taxes at the rate of 40 per cent from those having cash in abundance and bringing back the wealth tax. Baffled by the long list of unreasonable suggestions, netizens came down heavily upon the IRS officials.

The ongoing nationwide lockdown to combat the novel coronavirus outbreak has hit the economy of the country hard as most of the major businesses have come to a halt.

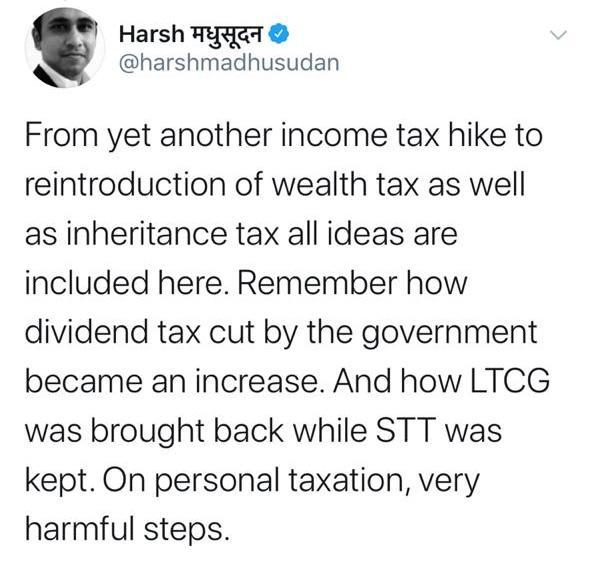

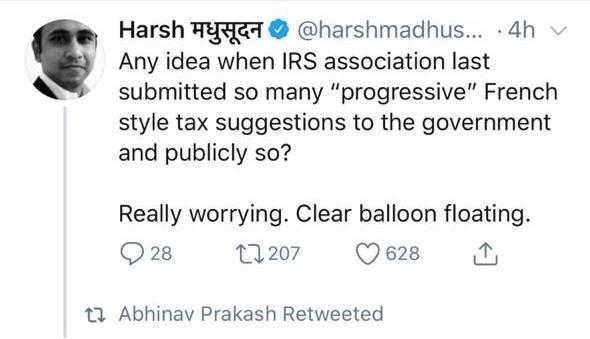

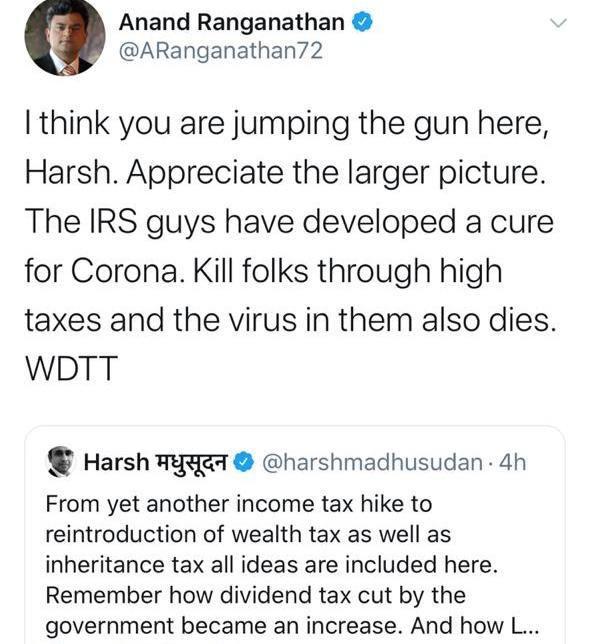

Thus, the IRS officers made some extreme recommendations to the Prime Minister's Office (PMO) as well as to the Finance Ministry of India for getting the economy back on its feet after the pandemic is over. However, they were soon subjected to widespread criticism on social media from all quarters.

IRS shares its ideas with the Centre

The association is of the view that the rich should bear the maximum burden as it suggests that those with income levels above Rs 1 crore must pay up to 40 per cent income tax while those with net income of more than Rs 5 crore should be made liable to pay the wealth tax.

Further, the IRS vouched to levy a one-time COVID-19 cess of 4 per cent on those with a taxable income of more than Rs 10 lakh.

"The government can identify 5-10 most crucial projects entailing significant expenditure, which are likely to help the economy revive. It should then ensure that the additional revenue raised through taxing the wealthy will only be used for those projects," the IRS officials suggested.

It also reckoned that the entire healthcare sector should be exempted from any sort of tax for a period of three years. "From a taxation perspective, a complete tax holiday or tax break is proposed for the next three years for all corporates, firms and businesses operating in the healthcare sector," the IRS said.

Stating that the digital companies are making the most out of the coronavirus lockdown, the IRS proposed that the tax imposed on Netflix, Amazon Prime and other online businesses should be increased by at least one per cent.

It further said that the Centre should set aside Rs 3,000 to Rs 5,000 per month for the 12 crore poor households for a period of six months. The IRS also wants the government to focus on the expansion of MGNREGA.

Here's a glimpse of how Indian Twitter is taking it