In the current times, mutual funds are considered to be one of the most secure and reliable financial instruments. Not only do they yield higher returns but they also ensure that your investment portfolio remains diversified. This simply means that you get to reap the benefits of professional money management, a varied security basket, and tax efficiency at a relatively low cost.

Most mutual funds available in the market today offer two different types of investment plans - Direct and Regular. Despite the advantages associated with a direct plan, a lot of people end up investing in a regular one. This is primarily because the direct plans are a fairly new phenomenon and investors aren't yet aware of what they truly entail.

What Are Direct Mutual Funds?

The Securities and Exchange Board of India (SEBI) first introduced direct mutual fund plans in January 2013. Before this, intermediaries used to levy an enormous amount of fee as transaction charges because regular plans were the only option available to the investors. Therefore, SEBI decided to provide a direct way to route people's money at almost no extra cost.

Direct mutual funds are those, which allow an investor to directly transact with an asset management company or a mutual fund utility. In other words, you do not have to avail the services of an intermediary like a banker or a broker. You can simply approach platforms like Orowealth.com and buy the funds and invest in them straight away without paying any commissions.

As a result, you don't have to pay a commission or a distribution fee due to which the expense ratio instantly comes down. Moreover, whether you start a SIP or make a lump sum investment, no transaction charges are levied in that case either. This means that the returns received on the fund can furnish up to 2% higher returns in the long run.

Since their inception, direct mutual funds have been largely well-received.

How Do Direct Mutual Funds Help You Save More?

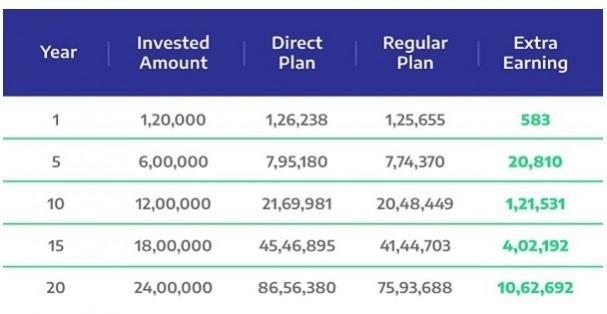

Let us help you understand how investing in direct mutual fund plans can help you generate great returns. Take a look at the image below. If you invest INR 10,000 in SIP for an investment horizon of 20 years, you will clearly see the difference in the number of returns you generate.

At present, we are at the cusp of a direct mutual fund revolution. The trust of investors on these type of financial instruments is steadily witnessing a massive rise. This can mostly be attributed to the low turnaround time and the greater returns associated with direct plans. More so, with more and more people wanting to take lower risks, the diversified set of investments which accompany direct plans are increasingly turning into an instant attraction.

In fact, the road ahead will be carved out with the help of online platforms like Orowealth. Orowealth.com has pioneered the zero commission investing in India. Not only will they help maximize your investment potential through their professionalism and competence but they will also use predictive technology and time-tested strategies to provide you with smart and efficient direct fund options.

Some misconceptions in the market about direct mutual fund investing is that it is only for the industry experts or people with sound market knowledge. Also, investing in direct mutual funds comes with no help or advisory. However, the reality is very different from this.

Orowealth.com was designed to address this need and help investors to take complete control of their finances. Once you sign up with Orowealth, they offer you a choice of a dedicated financial advisor who will take care of your portfolio and will also customize it according to your need. Orowealth's flagship OroAssist™ technology provides you custom-made portfolios depending on your risk profile and financial objectives. OroAssist™ constantly scan your portfolio and lets you know in an instant if there are some things that need your attention.

Advantages of Investing in Direct Mutual Funds

Though direct mutual funds have a plethora of advantages over their regular counterparts, here are the five distinct advantages, which make them stand out. These are:

- Direct mutual funds provide higher returns. This is because there is no third party involved and thus, no hidden costs are charged.

- The absence of an intermediary saves transaction charges. The funds are bought directly from the company/utility, either online or offline. Because there is no broker, no commission is levied.

- An expense ratio is basically the amount deducted from the investor's returns due to administrative expenses. In the case of direct mutual funds, the expense ratio is extremely low.

- The net asset value (NAV) of direct mutual funds is significantly high. This means that in the long-term, these funds would provide much more value to the investor as opposed to regular funds.

- Direct mutual funds are simple to understand, easy to process and quick to yield results. They provide the investor with multiple options, which are further customized as per their financial requirements.

How Have Investors Received Direct Mutual Funds?

In the five years since their introduction, direct mutual funds have heavily influenced investors. These have largely been positive and productive. A few of these have been listed below:

- Hundreds of open-ended mutual fund schemes have been clubbed together under the direct and regular categories. This has made the investment process much simpler.

- The investors are now able to select a scheme of their choice in a far more seamless manner than they previously could. Uniformity across direct mutual funds has greatly reduced complexity.

- Direct mutual funds have facilitated a fair comparison between different kinds of schemes. This is because funds within the same category now have similar characteristics. Investors have, therefore, begun to realign their investment strategy accordingly.

- The direct plans have not just raised the stakes in terms of higher returns, better NAV, and lower expense ratios but have also increased the level of certainty.

- The direct fund managers cannot singularly make a change in their investment mandate anymore. Any variation in the investor's risk profile has to be well-planned and pre-informed.

To conclude, if you want higher returns from your mutual funds:

1] Invest in Direct Plans.

2] Do so from a platform like Orowealth.com that provides personal advice to you on which funds to invest in to get the most returns.