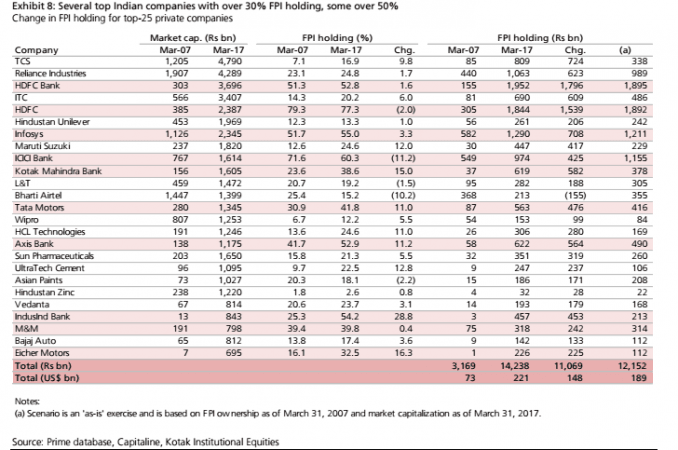

Listed Indian companies have seen interesting changes in their shareholding pattern in the past 10 years, with some of them finding favours with foreign portfolio investors (FPIs) who upped their stake in some blue-chip firms so much that they now own more than half of the equity.

FPIs held 55 percent of the equity holding in Infosys as of March 2017, up 3.3 percent from 51.7 percent 10 years ago (March 2007). They now own 77.3 percent of mortgage lender HDFC and 52.8 percent in HDFC Bank, according to brokerage Kotak Institutional Equities (KIE).

Other listed entities in which FPIs owned more than half of the equity include private sector lenders --IndusInd Bank (54.2 percent), Axis Bank (52.9 percent) and ICICI Bank (60.2 percent).

The brokerage, in its analysis of the shareholding pattern of India's blue-chip firms, said FPIs reduced their stake during the decade in Bharti Airtel, L&T, Asian Paints, HDFC and ICICI Bank.

Companies that saw FPIs increasing their stake during the decade (2007-2017) in a big way include TCS (up 9.8 percent), Kotak Mahindra Bank (up 15 percent), Maruti Suzuki (12 percent), IndusInd Bank (up 28.8 percent), Axis Bank (up 11.2 percent) and Eicher Motors (16.3 percent).

Here are the details of the companies with significant foreign shareholding: