Hiking taxes on gold sales in India could pressure short-term demand from the world's No.2 consumer of the metal, the World Gold Council (WGC) said in a report cited by Reuters on Thursday.

Reuters said in the report that faltering appetite for gold in a country where the much wanted yellow metal is used in everything from investment to wedding gifts could put a drag on global prices, already trading near their lowest level in 7 weeks.

"In the short term at least, we believe (the GST tax) may pose challenges for the industry. Small-scale artisans and retailers with varying degrees of tax compliance may struggle to adapt," Reuters said, quoting the WGC report.

As part of a new national sales tax regime that kicked in on July 1, the Goods and Services Tax (GST) on gold has jumped to 3 percent from 1.2 percent earlier.

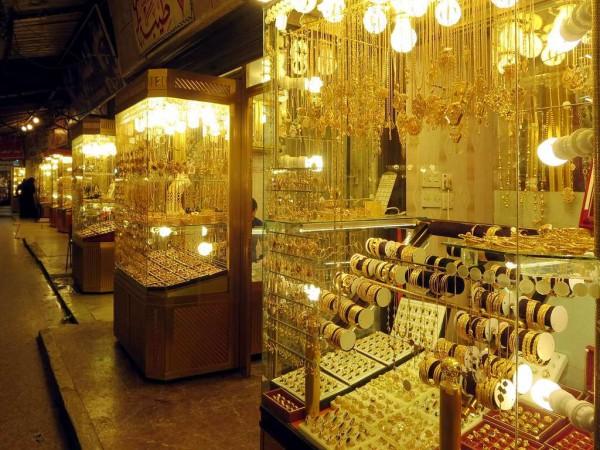

There have been fears that the tax increase could stoke under-the-counter buying and drive up an appetite for precious metal smuggled into India, where millions of people store chunks of their wealth in bullion and jewellery, the Reuters report said.

WGC also said that a government move to ban cash transactions over Rs 200,000 ($3,090) from April 1 could hurt gold demand in rural areas where farmers often purchase the metal using cash due to limited access to cheques and electronic payment systems.

Two-thirds of India's gold demand comes from the rural areas, where jewellery is a traditional store of wealth.

"The transactions rule's potential impact isn't entirely clear: it could curb gold purchases; it could encourage gold shoppers to buy smaller amounts of gold spread over more transactions, or it could push a large part of demand underground and encourage a black market in gold," WGC said.

In the long-term, the GST will have a positive effect on the gold industry by making the sector more transparent and improving the supply chain, WGC added.

The group kept its demand estimate for India at 650 to 750 tonnes for 2017, well below average annual demand of 846 tonnes in the past five years, according to the Reuters report.