Investors such as General Atlantic, Temasek and Goldman Sachs have been holding talks with online ticket booking platform BookMyShow to acquire 10-12 percent stake in it.

The three investors plan to outgun small shareholders like SAIF Partners -- which holds 5.6 percent stake -- and Accel India, by acquiring their shares in exchange of liquidity. According to a report in Economic Times, the deal is about to close within a few weeks.

The deal is going to provide SAIF Partners four times return on initial investment in the firm. Also, Accel will earn profits through the deal and will still hold some stake in the firm to enjoy the company's further success. SAIF Partners will be exiting from the company due to the conflict of interest that arises from its holding in Paytm, which has been competing against BookMyShow since 2016.

Private equity major General Atlantic has been competing with the other investors for the deal. The deal that General Atlantic is offering the online ticketing giant will give it a push to reach the $1 billion mark. According to ET, Avendus Capital was also in talks for a stake in BookMyShow, seeking a valuation hike to about $1.3 billion.

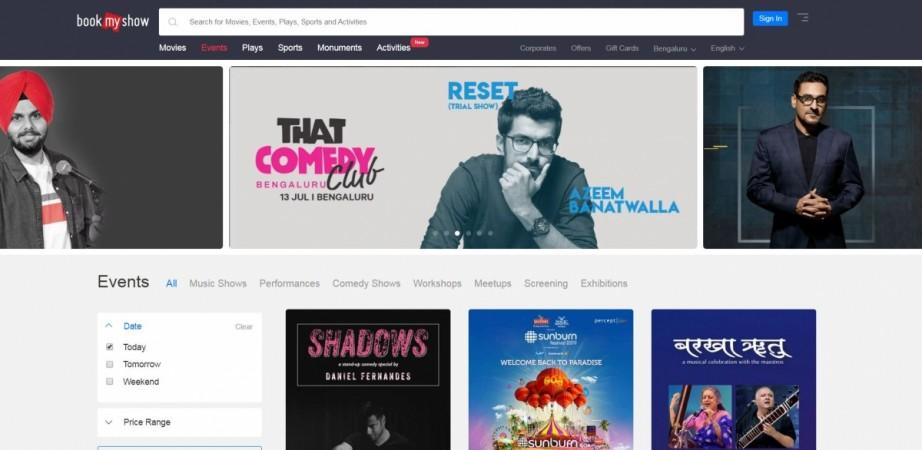

BookMyShow was founded by Ashish Hemrajani, Parikshit Dhar and Rajesh Balpande of Bigtree Entertainment. The company saw profits of Rs 391 crore in 2018 in the sale of movie tickets while it suffered a loss of about Rs 162 crore in the non-movie business.

The company has also invested in Payments Company AtomX.