Fairfax India Holdings Corp. is close to investing and acquiring a majority stake in Catholic Syrian Bank(CSB) after receiving an unoffocial by the Reserve Bank of India (RBI) marking the first takeover of a local private bank by a foreign investor.

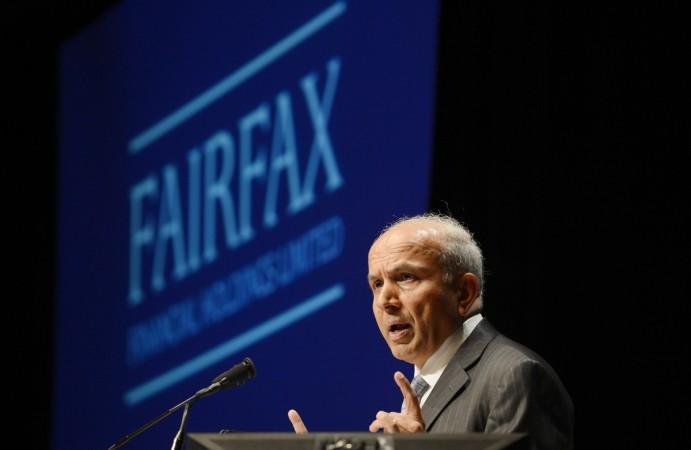

Prem Watsa, the Canadian billionaire and owner of Fairfax India Holdings Corp. met RBI governor Urjit Patel and deputy governors S.S. Mundra and R.S. Gandhi on Friday according to DealStreetAsia.

The Catholic Syrian Bank Limited, one of India's oldest private sector lenders is an Indian private sector bank with its headquarters at Thrissur, Kerala, India. According to Economic Times who cited sources said Fairfax is likely to have 15% voting rights in CSB.

The Fairfax proposal is expected to be heard by the board of Catholic Syrian Bank on Tuesday and Wednesday. LuLu Group MD Yusuffali M.A., Federal Bank, Bridge India Fund, and Edelweiss Finance and Investments are some of the shareholders of Catholic Syrian Bank.

However, the deal that is expected to involve an equity infusion by Fairfax will still require a final nod from the central board of RBI and several insiders such as S. Santhanakrishnan, chairman of Catholic Syrian Bank have declined to deny or accept the developments.

"We do not comment on any market rumours or speculation," Harsha Raghavan, managing director and chief executive of Fairbridge Capital Private Ltd, a Fairfax unit said according to DealStreetAsia.

RBI's changes in regulation that were introduced in May, to allow regulated, well-diversified and listed or supranational institutions to own up to 40%ownership in private banks were also measured with exemptions "as permitted on a case to case basis."

The new rules have capped Foreign direct investment or shareholding in a private sector bank by foreign entitiesin private banks at 74%. The RBI had also retained a provision under which investors have to seek its permission to increase shareholding/voting rights to 5% or more.

The bank has been seen as a lucrative investmentand and has often been on the takeover radar of bigger banks and corporates.

Compare to the same as September 2015, this year, the bank reported a net profit of Rs5.3 crore as compared to the loss of Rs 40.5 crore last year. Its gross non-performing assets dropped to Rs462.7 crore at the end of September, from Rs503.6 crore a year ago. Gross bad loans stand at 5.7% of advances.